Complete microfinance software

Get your microfinance system ready

to

go in 2 weeks

MFI software solution includes

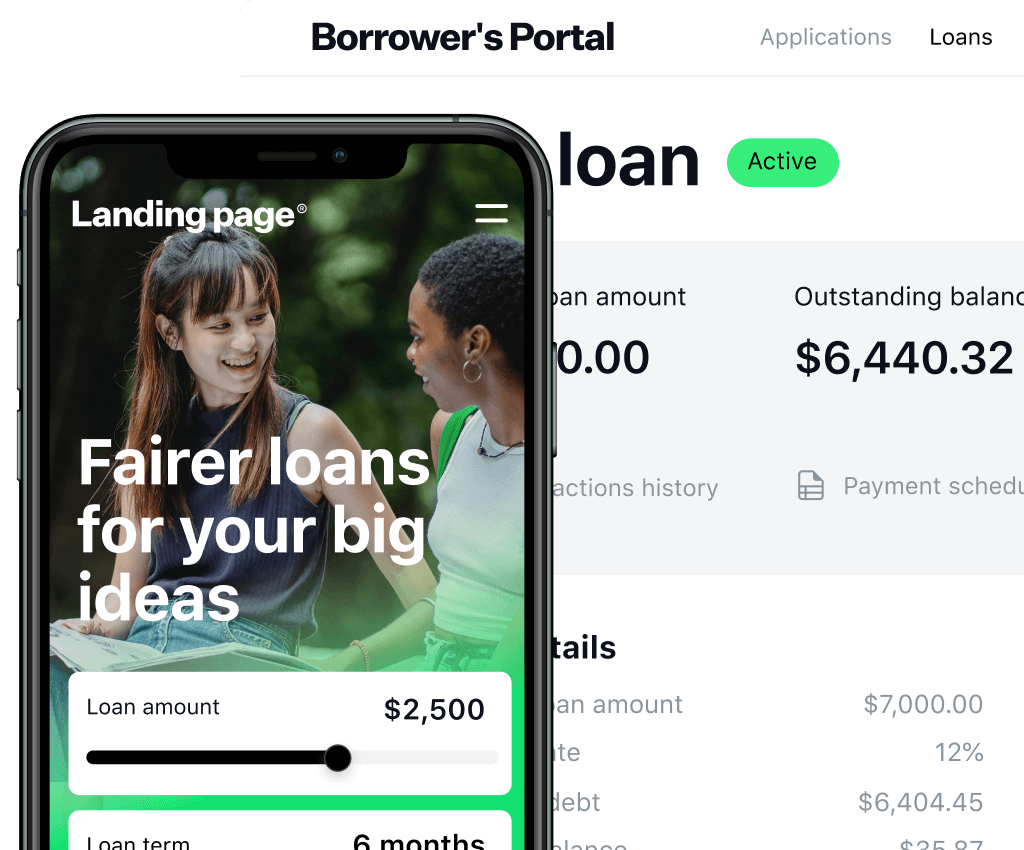

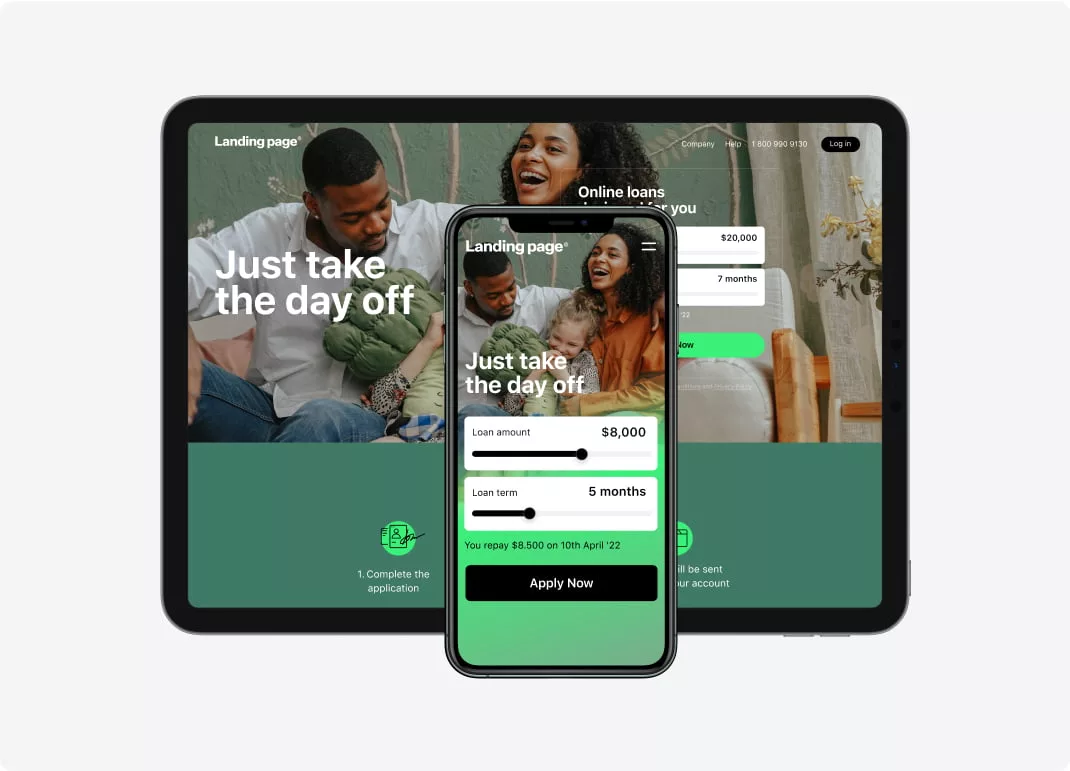

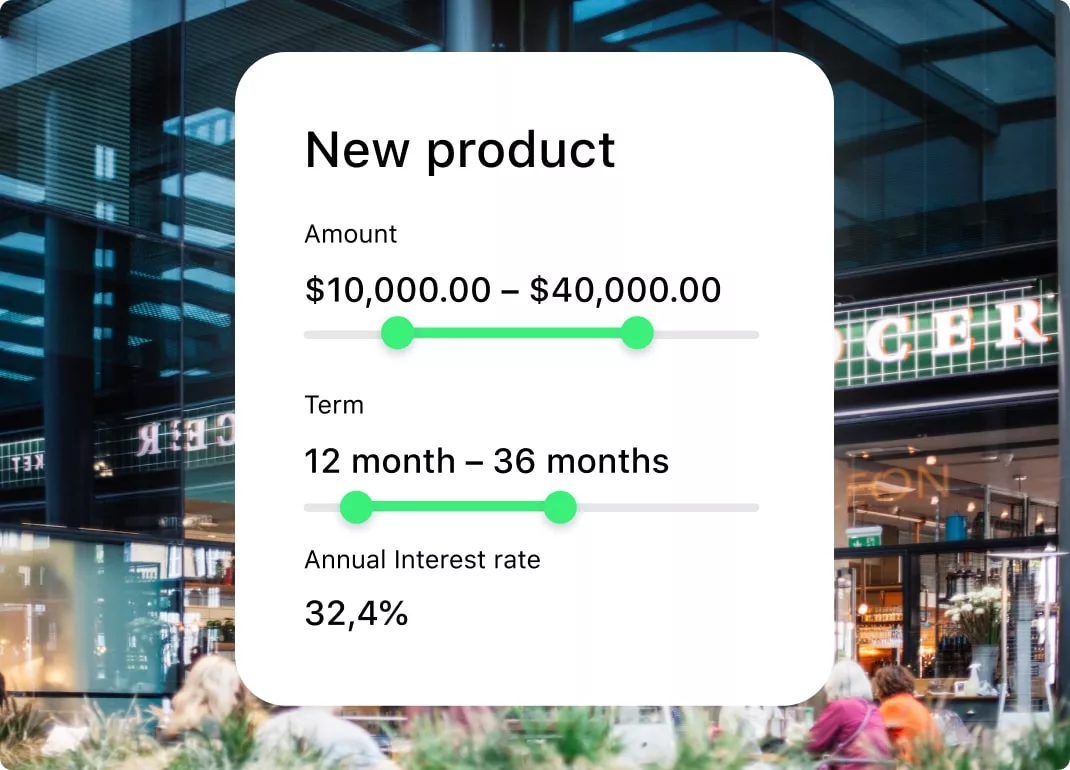

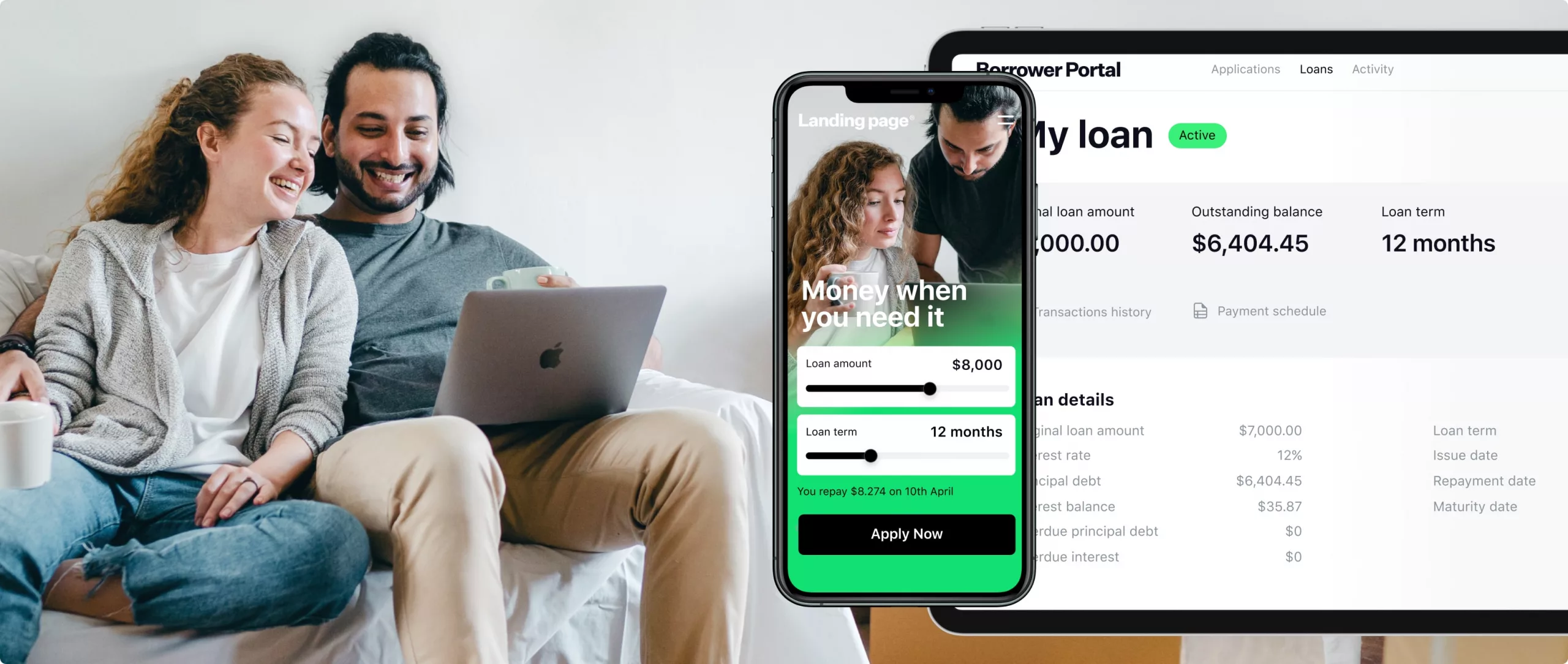

Landing Page

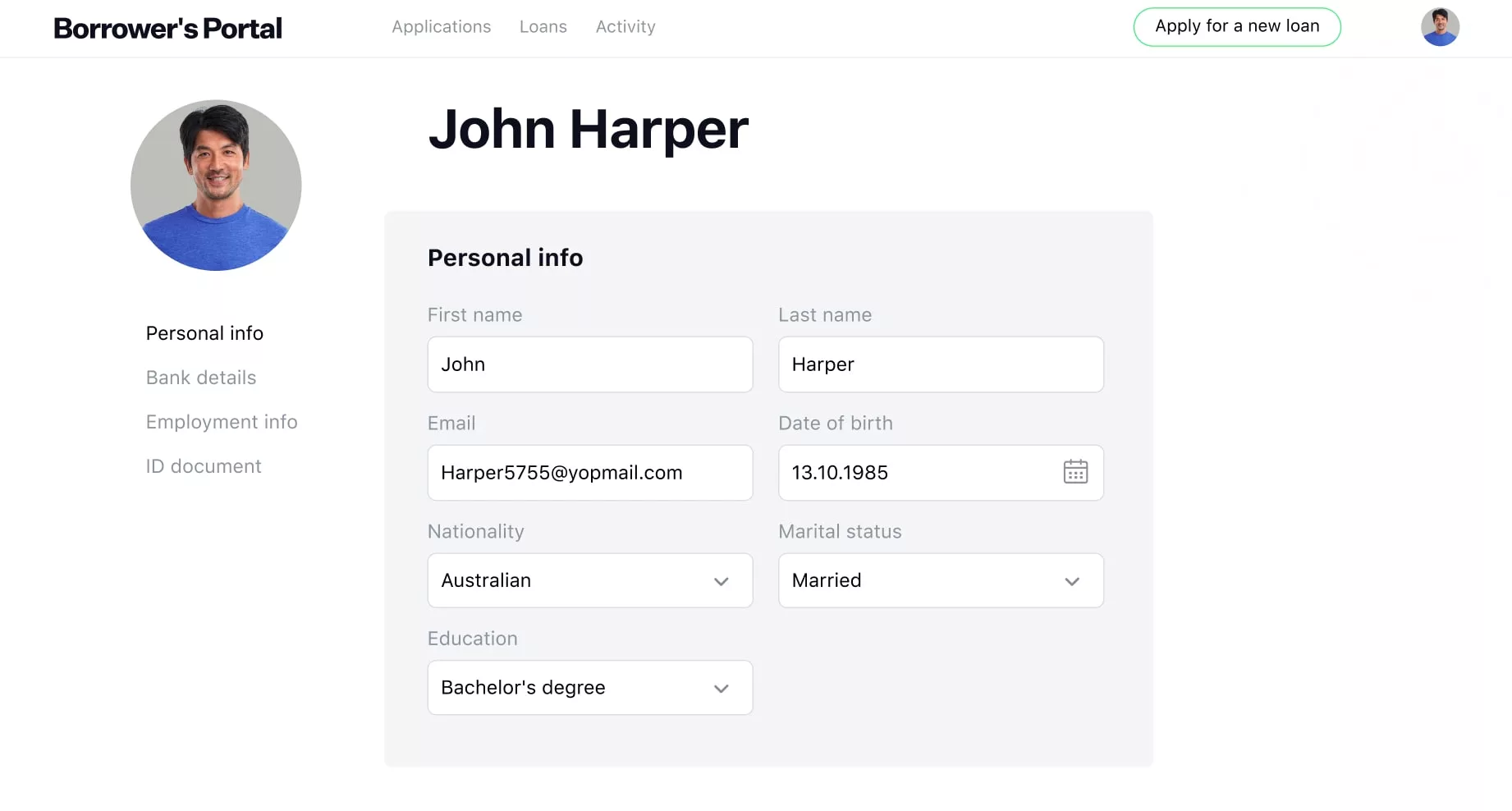

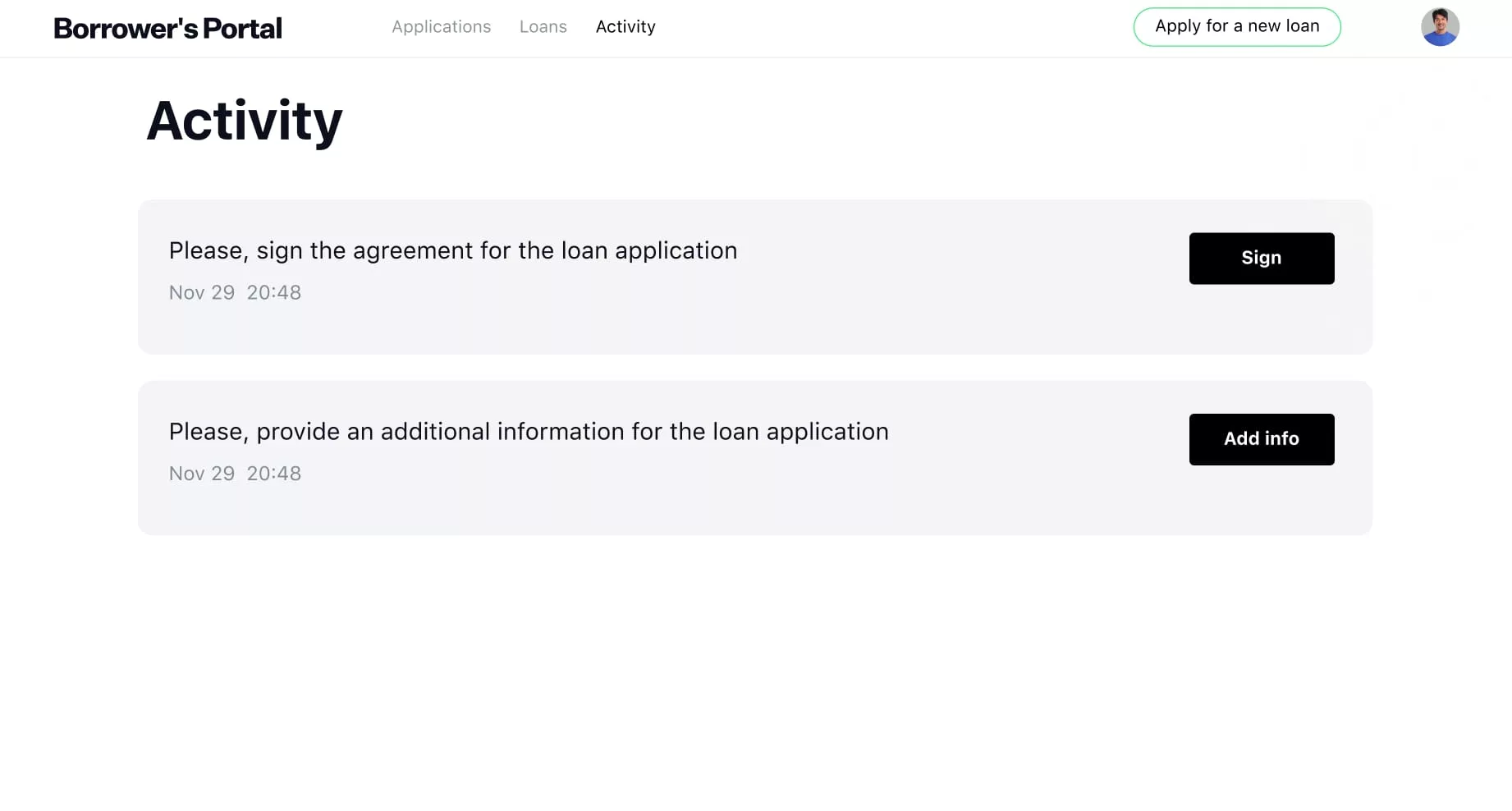

Borrower Portal

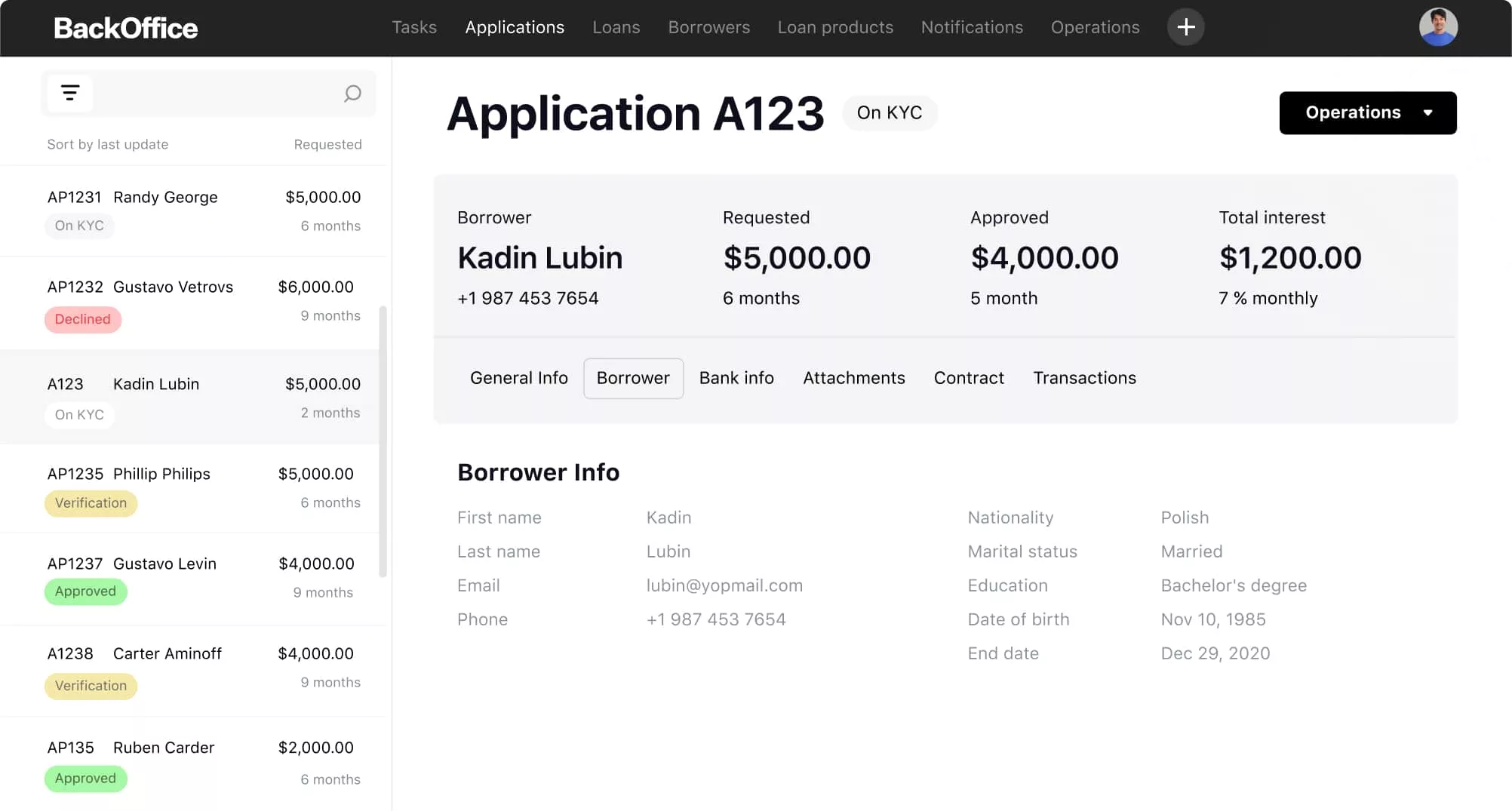

Back Office

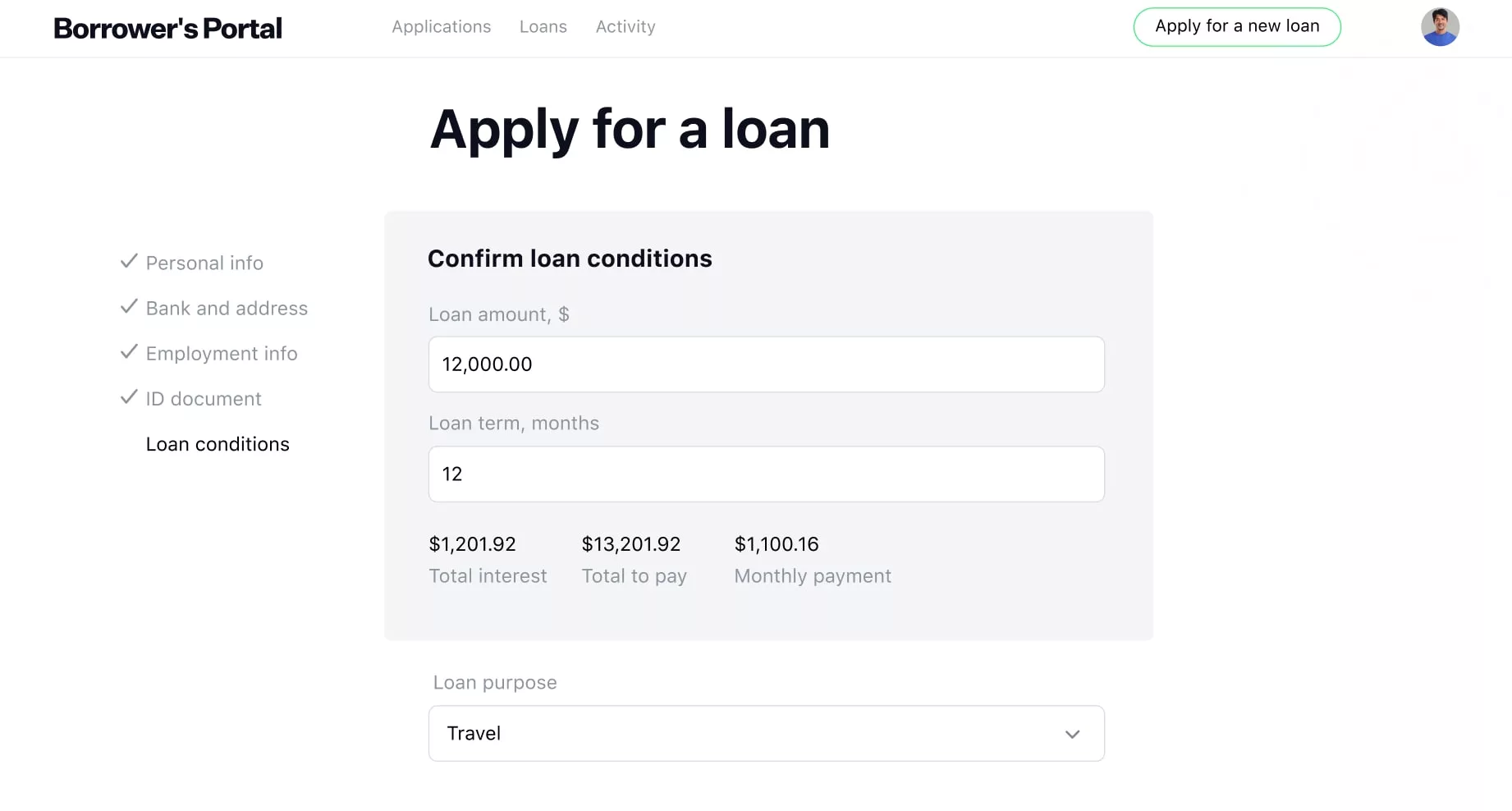

Online loan origination

One-roof assets management

Automated document flow

AI application scoring

Customizable calculations

100%

automated loan

management

management

The micro loan management system unifies all assets and

borrower data, providing

comprehensive control over

assets via microfinance management

software.

borrower data, providing

comprehensive control over

assets via microfinance management

software.

3.5x

faster loan

approval

approval

Our software streamlines data entry and document

organization,

decreasing manual

underwriting tasks,

freeing up time for business development.

organization,

decreasing manual

underwriting tasks,

freeing up time for business development.

2.5x

more precise

decisions

decisions

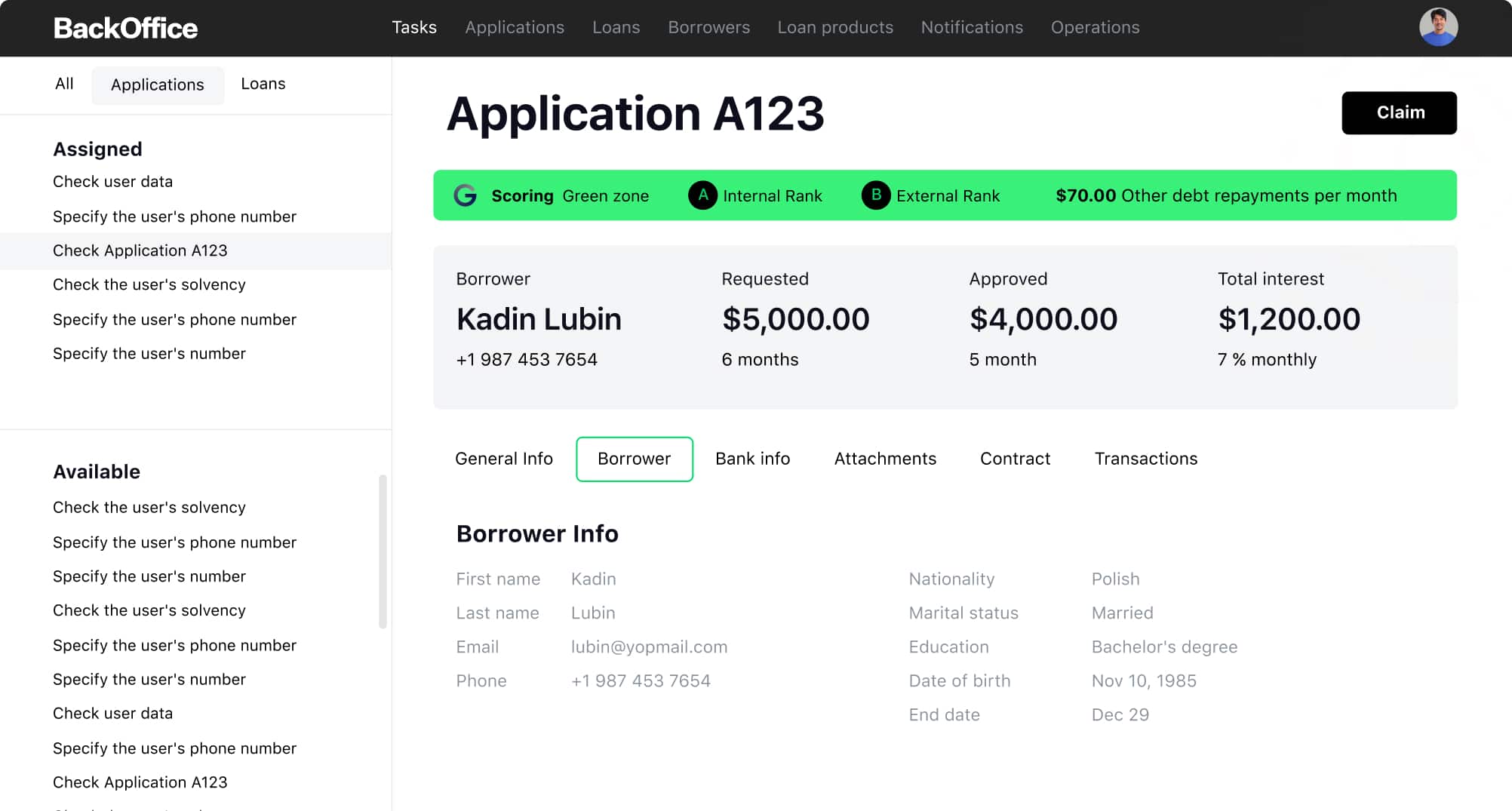

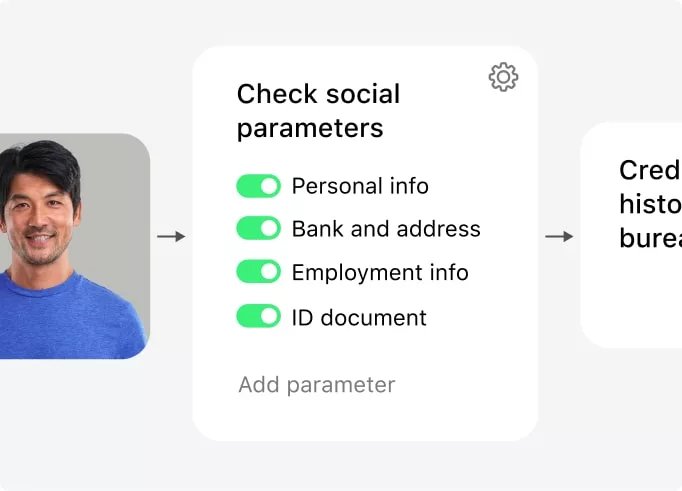

Microfinance system software employs AI for unbiased

credit

scoring, identifying high-risk

applications and

enabling more informed decisions.

credit

scoring, identifying high-risk

applications and

enabling more informed decisions.

90%

fewer

manual tasks

manual tasks

The versatile microfinance system uses online software to

expedite credit applications and

pre-score requests, thus

hastening approval times.

expedite credit applications and

pre-score requests, thus

hastening approval times.

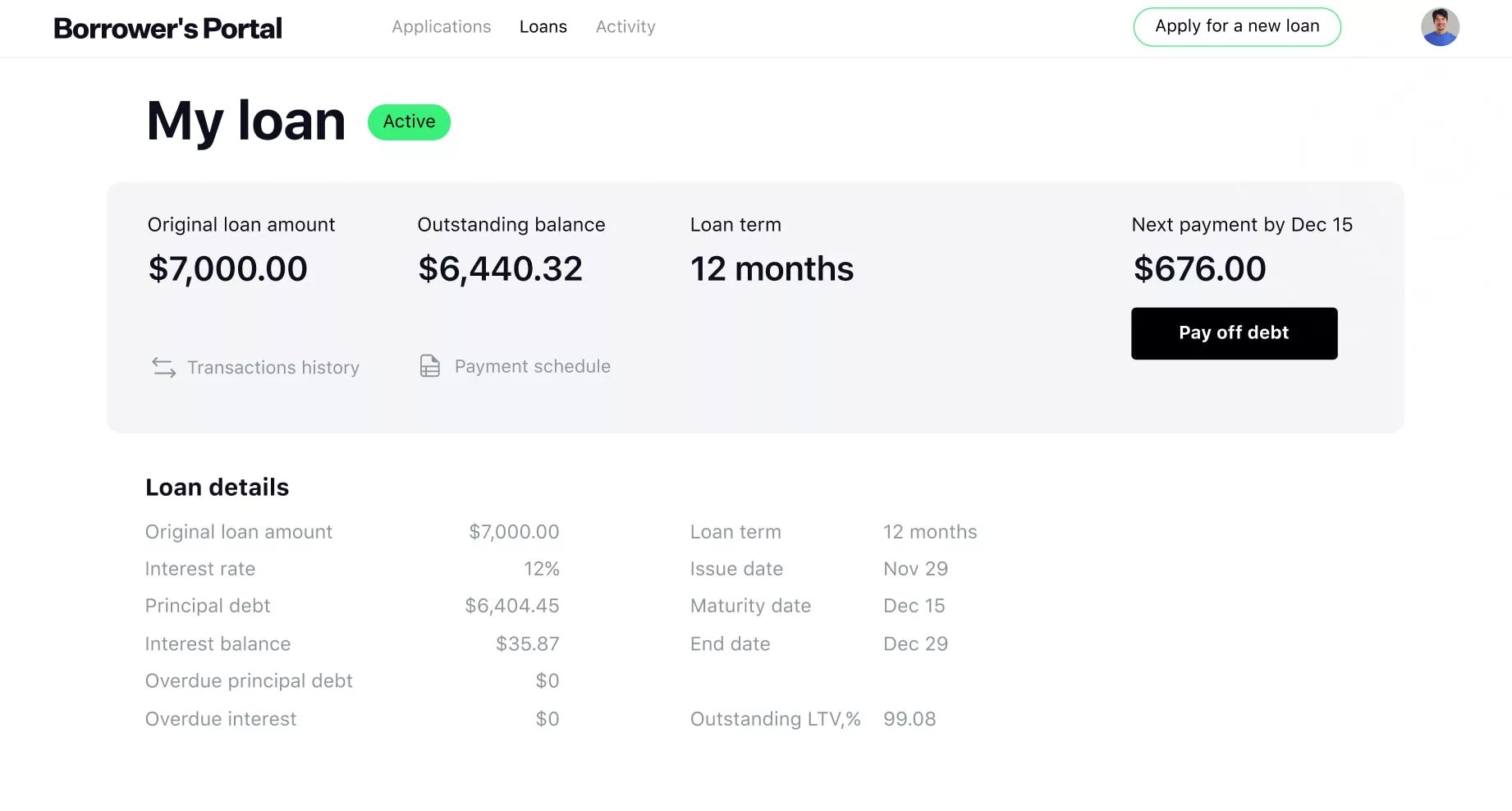

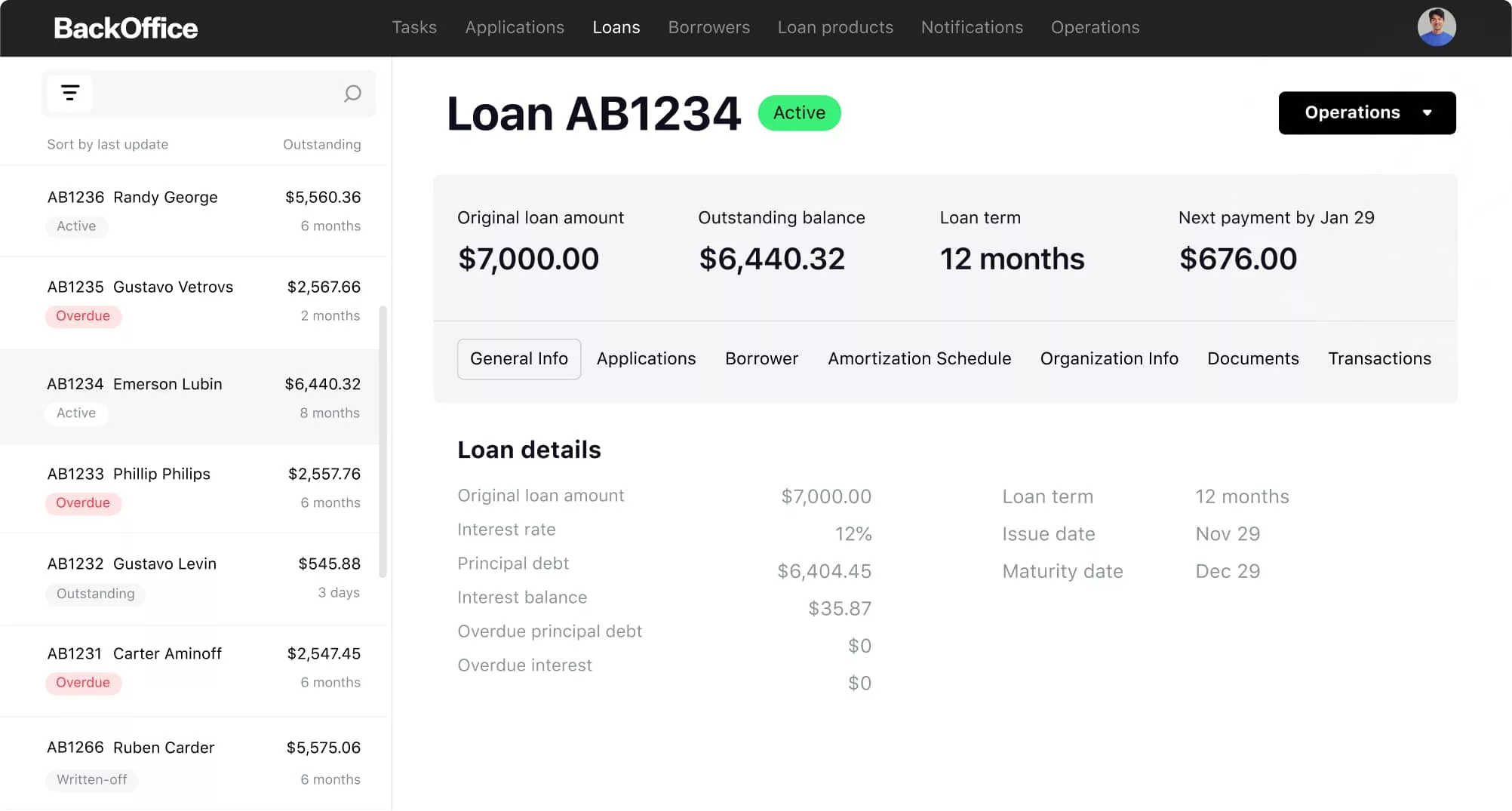

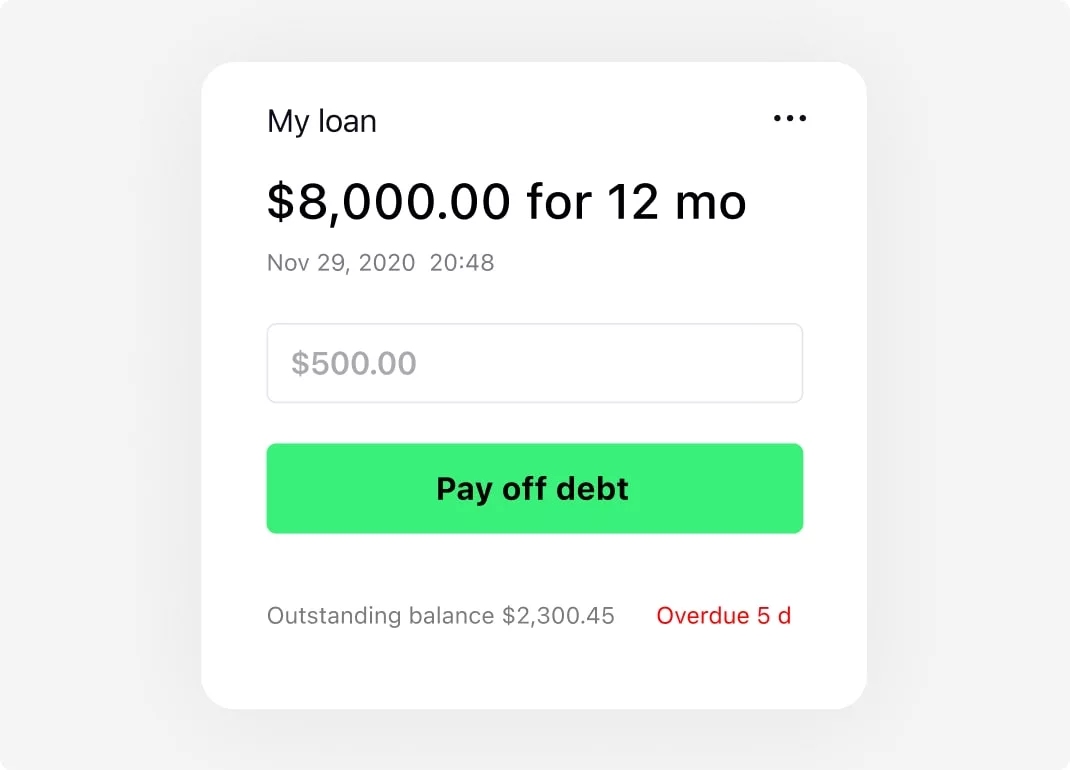

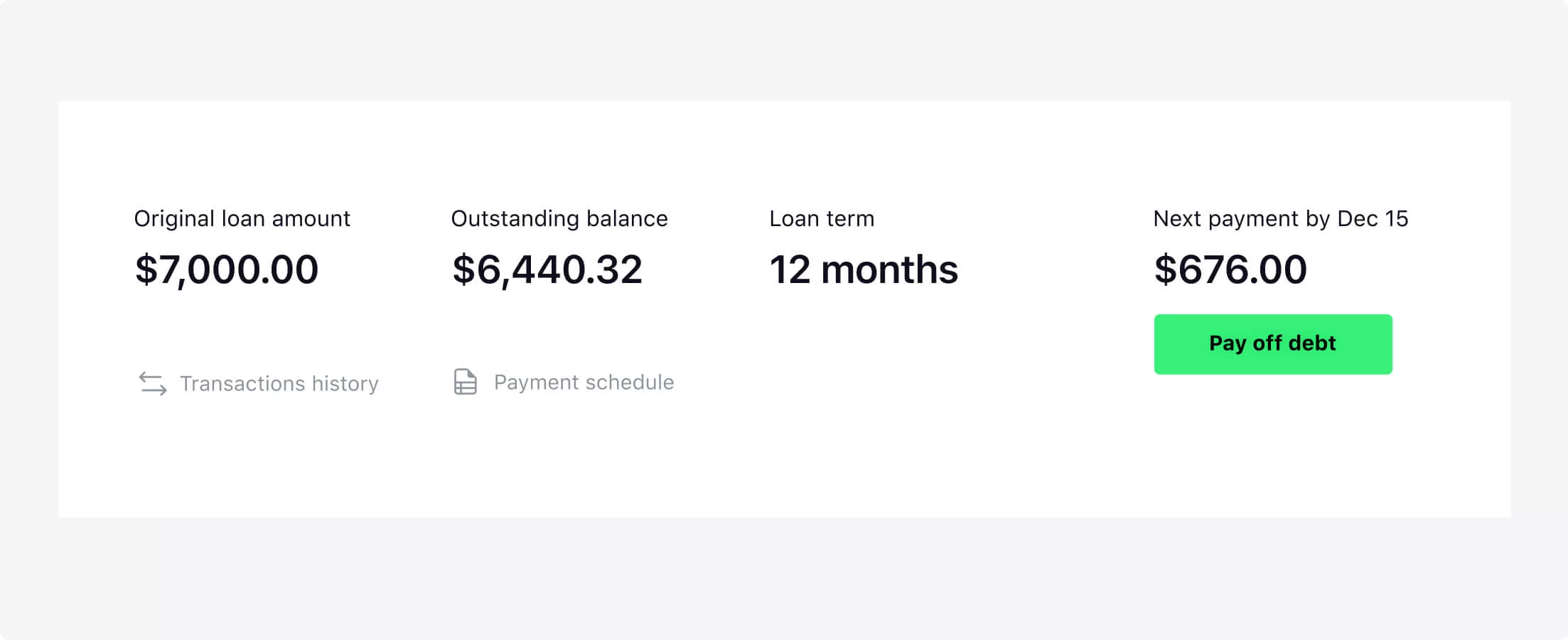

Active loan

Once a loan is approved, customers can track the payment schedule, credit terms, and due amounts

in their

personal space. Front-end micro credit software allows

users to manage their debt

online. The borrower portal

integrates with payment providers, so

clients are free to conduct

transactions on the spot.

in their

personal space. Front-end micro credit software allows

users to manage their debt

online. The borrower portal

integrates with payment providers, so

clients are free to conduct

transactions on the spot.

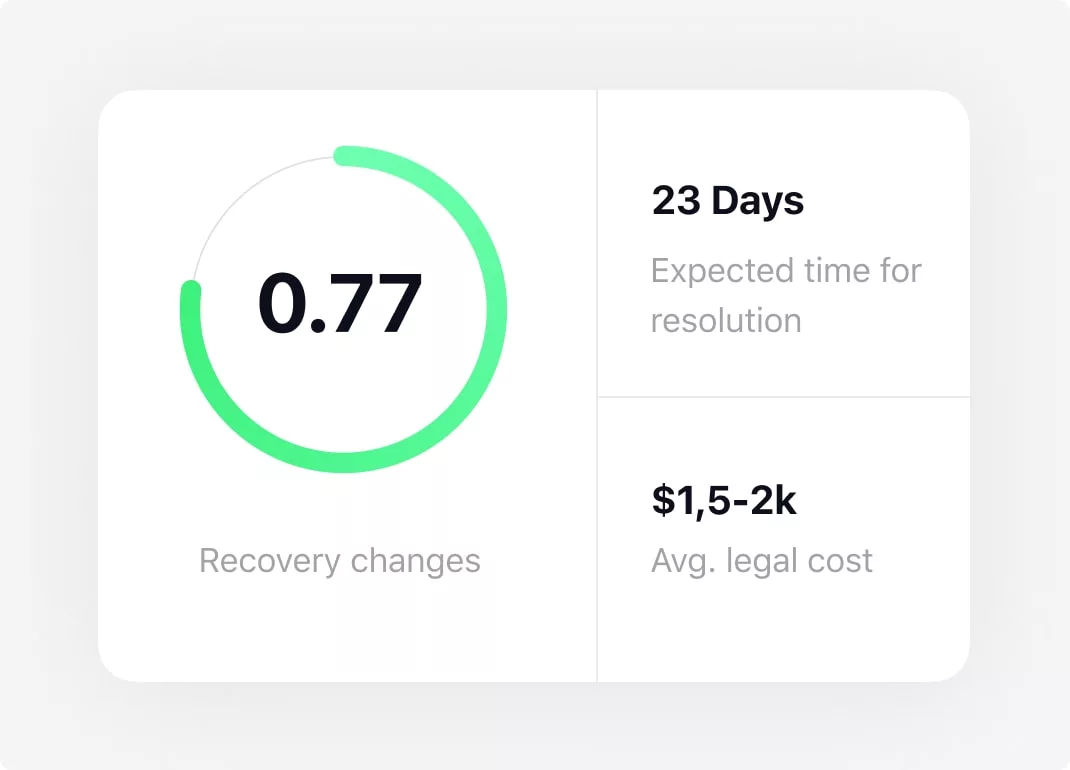

Microfinancing

software AI

Harness the power of AI to score loan

portfolios, automate

debt

collection,

and receive data-driven insights.

portfolios, automate

debt

collection,

and receive data-driven insights.

Your benefits with HES

Rapid launch

Ensure the fastest ROI possible by launching a micro lending platform

in a record 14 days.

The microfinance management system is ready

to deploy and only

takes

some time to tailor according to your needs.

in a record 14 days.

The microfinance management system is ready

to deploy and only

takes

some time to tailor according to your needs.

MFI software expertise

The team of BAs with over 10 years of hands-on experience in multiple

types of lending institutions is

ready to meet your business requirements.

HES’ micro finance

solutions are made by lendersfor lenders.

types of lending institutions is

ready to meet your business requirements.

HES’ micro finance

solutions are made by lendersfor lenders.

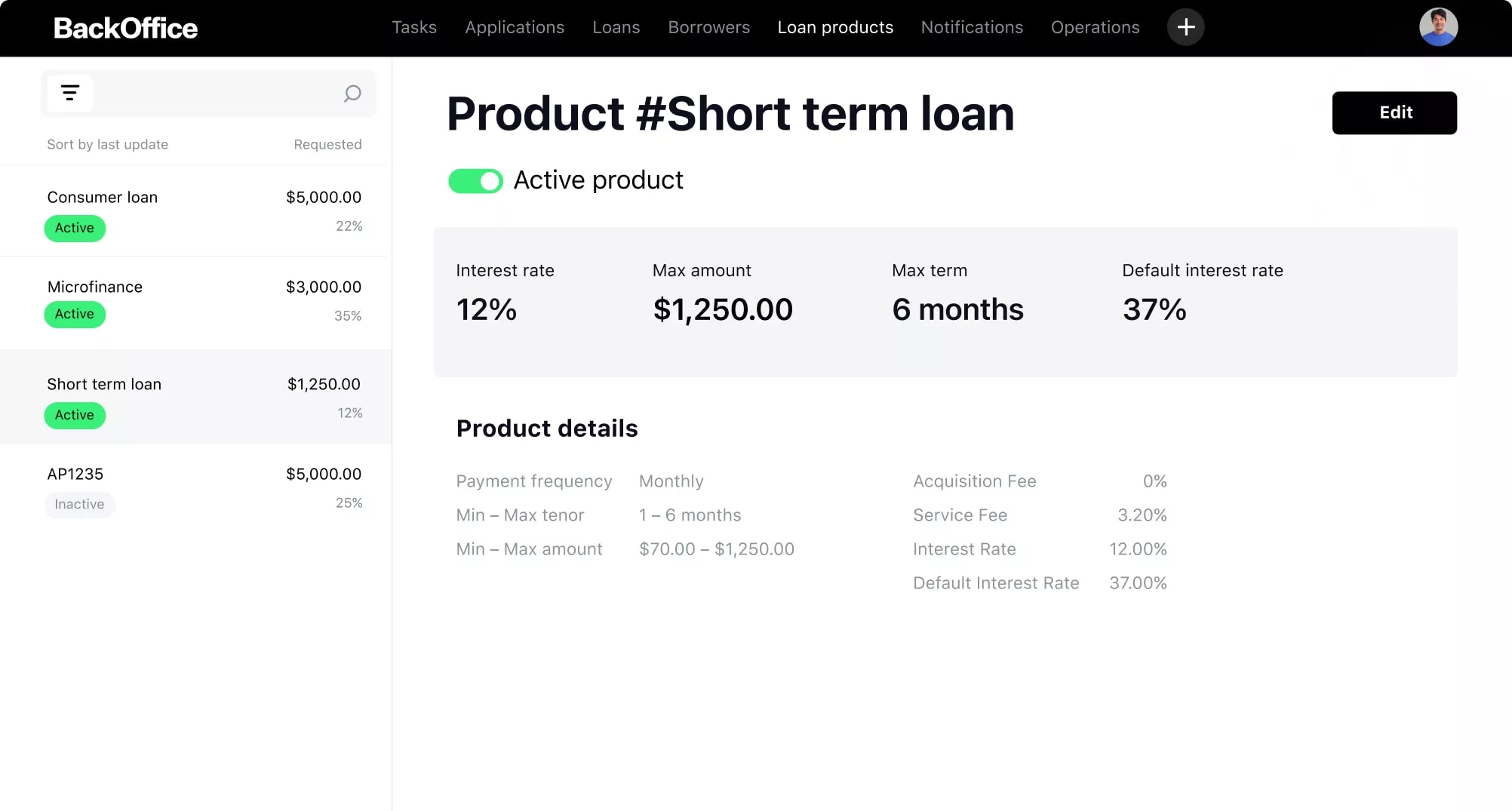

Scalability and customization

Enjoy unlimited customization to tailor modules, add features, and fine-tune interfaces.

Seamlessly integrate

with reporting, accounting, payments, and credit bureaus.

Effortlessly expand your business with the micro finance

solution’s smooth growth path.

Seamlessly integrate

with reporting, accounting, payments, and credit bureaus.

Effortlessly expand your business with the micro finance

solution’s smooth growth path.

Customer support

Count on our dedicated customer support team for all your needs. Whether you have

questions, issues, or need guidance,

we’re here to ensure your satisfaction. Reach

out to us anytime

for

prompt assistance and effective utilization of our services.

questions, issues, or need guidance,

we’re here to ensure your satisfaction. Reach

out to us anytime

for

prompt assistance and effective utilization of our services.

Security and stability

HES is ISO 27001 certified. Microfinance technology solutions are deployed with Amazon

AWS

or Google Cloud. The latest Java

LTS stack maintains stable and future-proof operation.

Regular

security updates ensure the safety of your data.

AWS

or Google Cloud. The latest Java

LTS stack maintains stable and future-proof operation.

Regular

security updates ensure the safety of your data.

Powerful micro loan

software features

Custom workflows

Visualize the workflow and apply it to the entire system effortlessly. The microfinance

platform

maintains multiple workflows, enabling you to operate with freedom and flexibility.

platform

maintains multiple workflows, enabling you to operate with freedom and flexibility.

Transactions

Automatic disbursements and repayments, direct debit and daily transactions are all

registered

in micro-lending software, giving the unified access to online tracking.

registered

in micro-lending software, giving the unified access to online tracking.

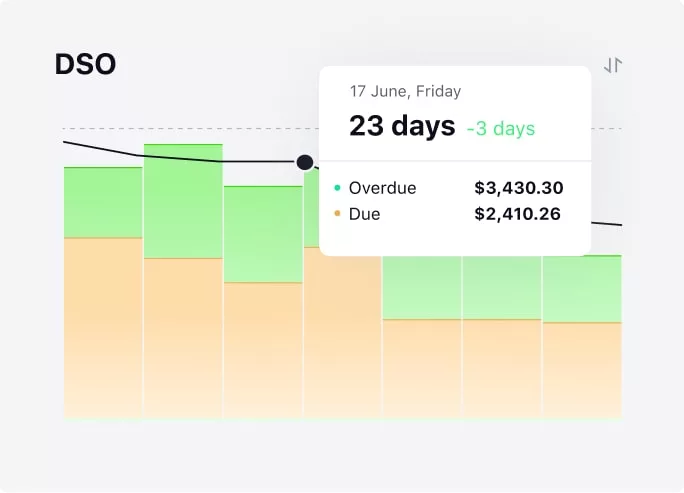

Reports and dashboards

The system collects data and constructs interactive dashboards to track your essential KPIs.

Export data and customize metrics according to your business requirements.

Export data and customize metrics according to your business requirements.

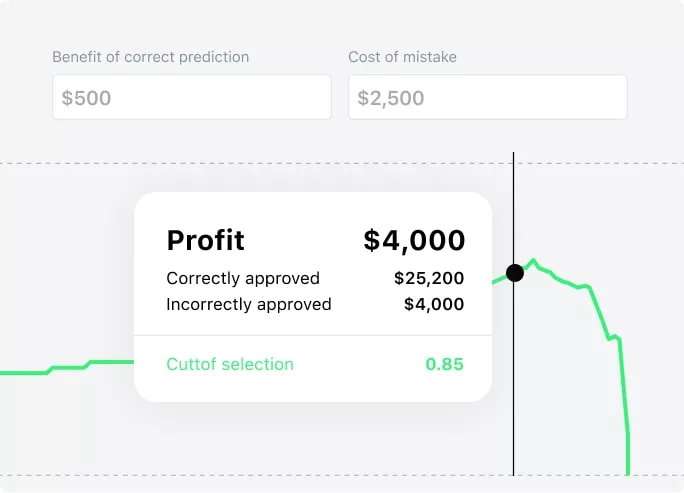

Risk management

Use AI for credit scoring to predict defaults and assess risk. Gain actionable insights by

scoring credit portfolios. Set a cut-off threshold to define risky assets and predict NPLs.

scoring credit portfolios. Set a cut-off threshold to define risky assets and predict NPLs.

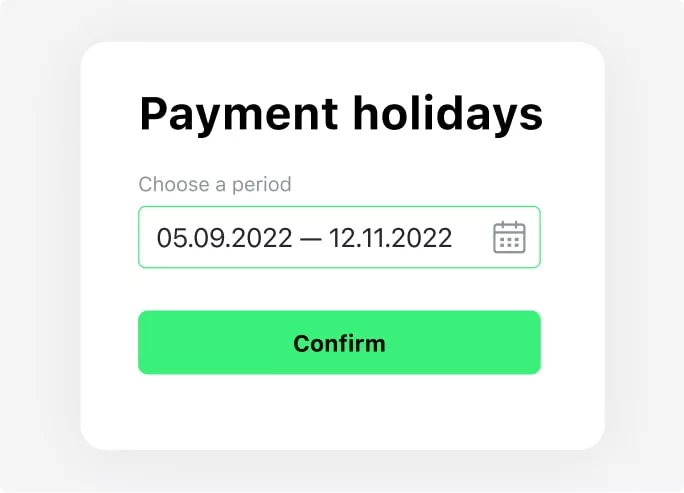

Payment holidays

Micro-finance servicing software by HES allows you to set payment holidays and grace periods

over selected loans, giving your business more loyal clients and better customer retention

rates.

over selected loans, giving your business more loyal clients and better customer retention

rates.

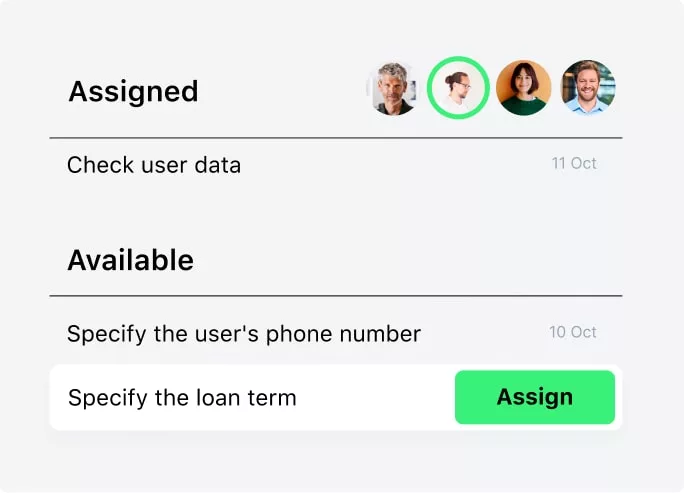

Task management

Implement the micro-lending solution to synchronize the loan officers’ work. The built-in

task

management module helps you allocate tasks and monitor their performance.

task

management module helps you allocate tasks and monitor their performance.

E-signature

Automate KYC process and ID verification processes with in-house, AI, or 3rd party

integration

while staying compliant with compliance requirements.

integration

while staying compliant with compliance requirements.

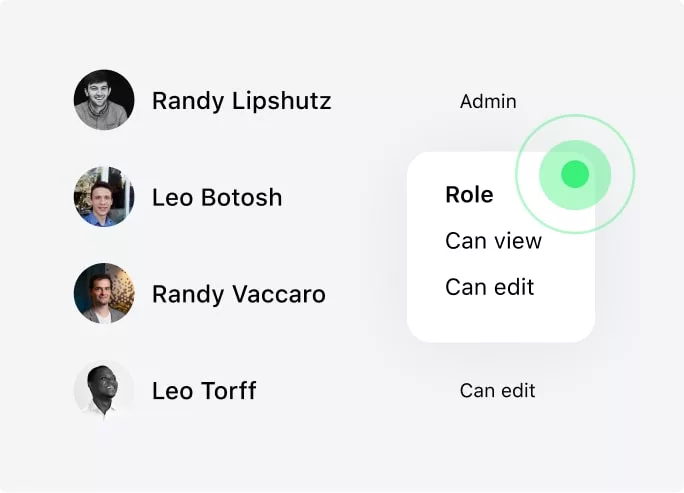

Roles and permissions

Minimize risks of breaches with role-based user permissions. Micro loan management software

lets

you limit access to system functions according to a user role.

lets

you limit access to system functions according to a user role.

Microfinance

system integrations

Book a microfinance software demo to explore

the power of automation

HES FinTech has been working in the microfinance management software industry since 2012 and has

successfully released

over 160 projects for clients from 40+ countries worldwide.

Ad-hoc microfinance loan

management system

End-to-end microfinancing software

Equip your business with powerful micro-lending software covering loan

processing tasks in full. Flexible functionality

automates manual tasks from onboarding to underwriting to full

repayment.

processing tasks in full. Flexible functionality

automates manual tasks from onboarding to underwriting to full

repayment.

2 weeks time-to-market

HES micro-finance system is ready for a launch in just 2 weeks. Benefit

from

fine-tuning of micro-finance software for your

business needs. Expand your capabilities with microfinance management

software.

from

fine-tuning of micro-finance software for your

business needs. Expand your capabilities with microfinance management

software.

Lifelong customer support

Utilize the power of AI-based microfinance system with full confidence.

The

HES team provides customer support and employee

training upon your request.

The

HES team provides customer support and employee

training upon your request.

No additional charges per customer

HES

provides

fully managed microfinance software solutions with no limits

on the number of users. Flexible pricing depends on the features you

choose.

Request the microfinance software demo to learn more.

provides

fully managed microfinance software solutions with no limits

on the number of users. Flexible pricing depends on the features you

choose.

Request the microfinance software demo to learn more.