Borrowers opt for paperless loan origination and less time consuming application processing, so how to meet their needs? There’s no doubt that the rapid development of the fintech domain has severely undermined traditional lenders. An automated loan processing system is the greatest solution to survive and thrive. By 2023, it is estimated that the average transaction value per user in the Alternative Financing segment will be around US$179.80k. It’s transforming traditional lending into intelligent digital servicing by automating and eliminating manual processes by above 90%.

Let’s explore the benefits of loan processing automation with loan origination software by HES FinTech. What market challenges force lenders to go digital? And what aspects to consider while choosing a software vendor?

What is Loan Origination?

Loan origination covers the loan lifecycle from application to disbursement in the borrower’s bank account. However, if you ask lenders to come up with the definition of the term “loan origination”, every one of them will see it differently.

The process of loan origination (or borrower onboarding) includes several steps when taking an application to final approval or rejection. Besides, loan types vary, and so do approval processes for each type. Even though the steps in processing a loan may be different for each provider, many lenders would agree that data-driven loan origination systems (LOSs) are great tools for risk officers. Such loan management software reduces manual processes through automation and helps meet the variety of challenges facing the lending industry.

Loan Origination and the Challenges in the Lending Market

One such challenge is the ever-growing list of regulations put in place as a response to fraudulent behavior and Ponzi-like schemes carried out by non-established players in multiple countries, especially in Southeast Asia. On a global scale, the regulation of the alternative lending market has evolved significantly in recent years; policymakers expect to increase consumers’ access to finance by 65% in the coming years. However, the introduction of regulations is still a major challenge for both regulators and fintechs.

On the one hand, regulatory policies must work toward the broad financial inclusion of the underbanked. On the other hand, regulations must address a set of risks that could compromise the whole lending industry. The regulatory efforts in the United Kingdom represent a practical model to follow on account of flexible local regulation conditions. New additions to legislation contain specific points that need to be accounted for, and a proper automated loan processing system can help lenders adhere to regulatory compliance while optimizing their workload.

Looking for robust loan origination software?

Lenders that don’t have a single LOS platform in place have to manage all types of loans differently. In general, the process is as follows: a client submits a loan application along with all necessary documents, and then risk officers manually check the completeness and correctness of the (usually dozens) of documents. This paper-based approach often results in inconsistent decisions and affects profitability as it takes a lot more time to process each client’s case. Additionally, it usually leads to errors that deeply affect the quality of a lending organization’s services.

Tough competition in today’s lending market is also playing its part. Modern customers are well-informed of the potential lending options available to them. If for any reason a lending company doesn’t process a loan application promptly, clients can simply switch to another firm in no time.

Advantages of the Automated Loan Origination Process

Automation, whether you think it’s just a marketing buzzword or not, has already increased the efficiency of numerous industries worldwide including finance and banking. Lending is no exception.

A well-structured application processing system allows institutions to optimize decision-making and saves borrowers’ time, thereby making their services accessible to a wider audience. Analytical tools within the loan origination solution provide additional value by allowing lenders to continually improve efficiency and loan performance.

Benefits of using loan origination platform include:

- A single centralized system

- Compliance with lending regulations

- Reduced loan approval time

- Elimination of manual loan processes

- A faster and more accurate underwriting process

- Better customer relationship management

- Fraud detection

- Simple and easy lending audits

- Diminished risks of data compromise

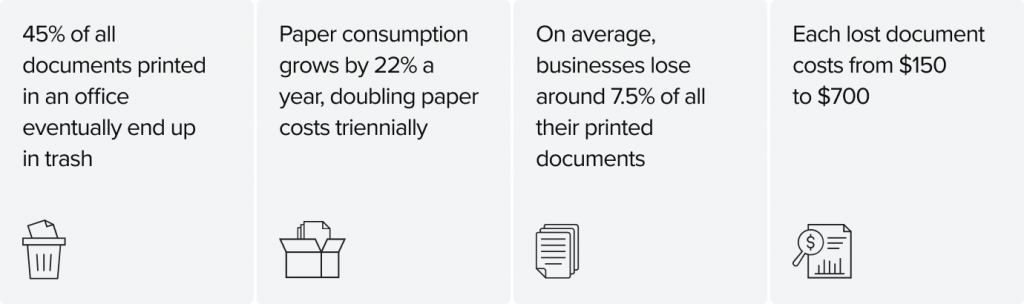

Developed using cloud and web technologies, a loan origination process flow provides a better customer experience and eliminates paper documents. Did you know that companies in the US only spend over $120 billion per year on printed forms? Most of these printed documents become outdated in around three months.

However, according to the Federal Reserve survey, most businesses keep following a paper-based approach thus 49% of borrowers still find the application process to be difficult.

For lenders, most business activities begin with an incoming loan request from a client. In light of this, investing in a single-platform automation solution might be the best choice for lenders looking to scale up and beat the competition.

Questions to Ask Your LOS provider

How to Choose the Top Loan Origination System for Your BusinessWhen choosing a technology partner, it’s best to ask a potential LOS provider the following questions:

- Can the solution support onboarding both individuals and legal entities?

- Can the solution process applications from different channels?

- What data sources can be connected at the stage of onboarding?

- Is the design responsive?

- Is there a mobile app? Is there a basic configuration for a mobile application? Is it possible to make a mobile application on our own and connect to your system?

- Is the solution able to extract data from photos and documents?

- Is there an opportunity to implement a face recognition feature?

- Can I add multiple languages?

All these questions make it easier to understand (and recreate) the key attributes of a loan origination system with automated loan processing just the way you want it.

Read also

Conclusion

There’s one more aspect to talk about: with all the high-profile scandals in the industry, there’s a need to create a healthier ecosystem for regulators, borrowers, and lenders. But what exactly does that mean?

Rather than focusing solely on profits, lenders should add more transparency to their businesses. Within a lending organization, transparency is the key to providing borrowers with clear info on the progress of their loan application and their annual percentage rate (APR) so they can make informed decisions. The domain of finance requires responsible innovations, and an automated loan processing system provides just that. Overall, the lending industry should provide borrowers with convenient access to capital on reasonable terms.

When talking about challenges in the lending industry, one must realize that the adoption of loan processing automation and credit underwriting is a challenge in itself. But as the competition is getting tougher, an efficient software deployment strategy means the difference between a growing client account portfolio and just making ends meet.