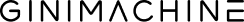

Complete loan automation

with digital lending software

Loan system software

Readymade online lending platform

100%

convenience

for staff

for staff

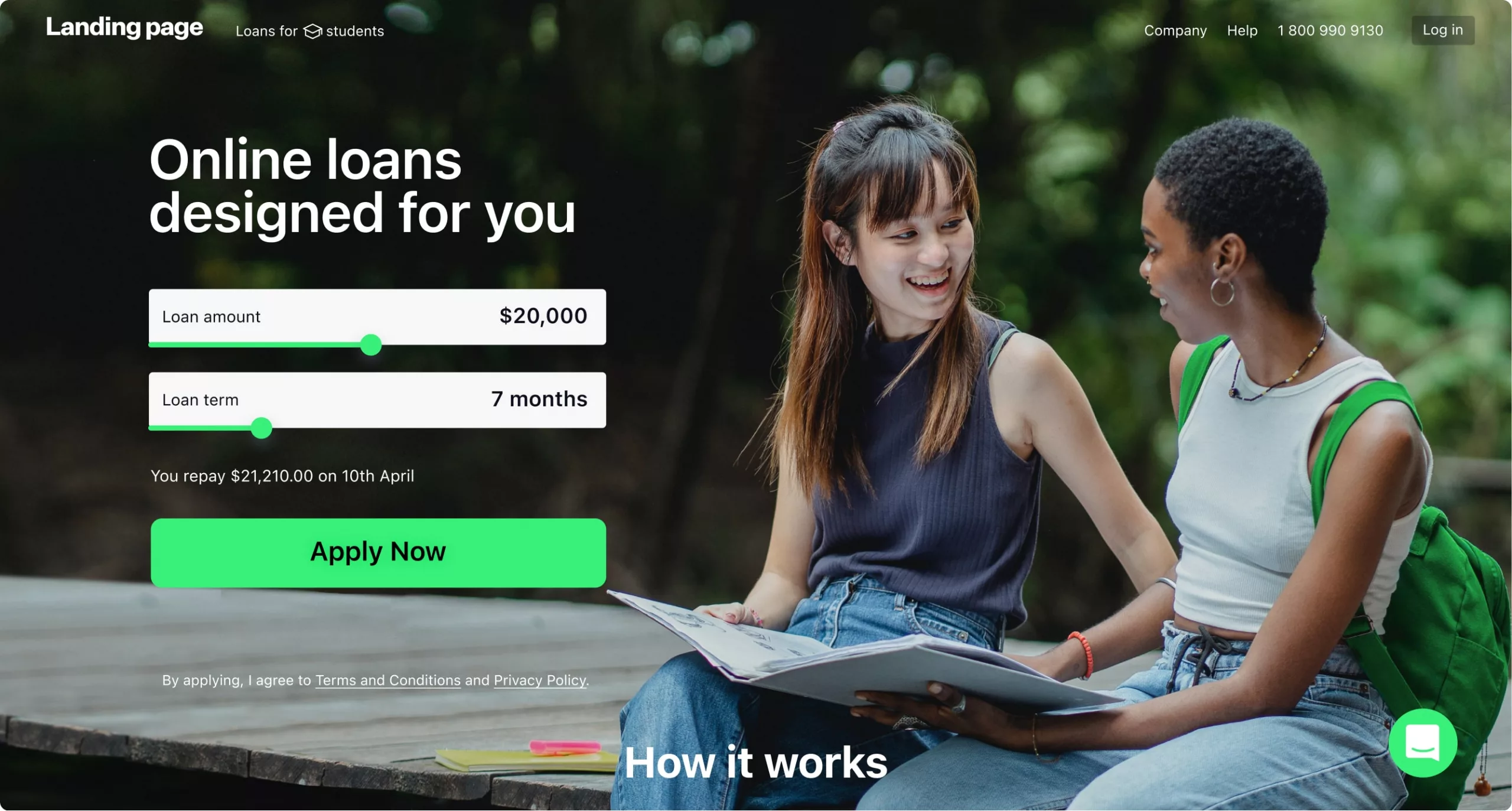

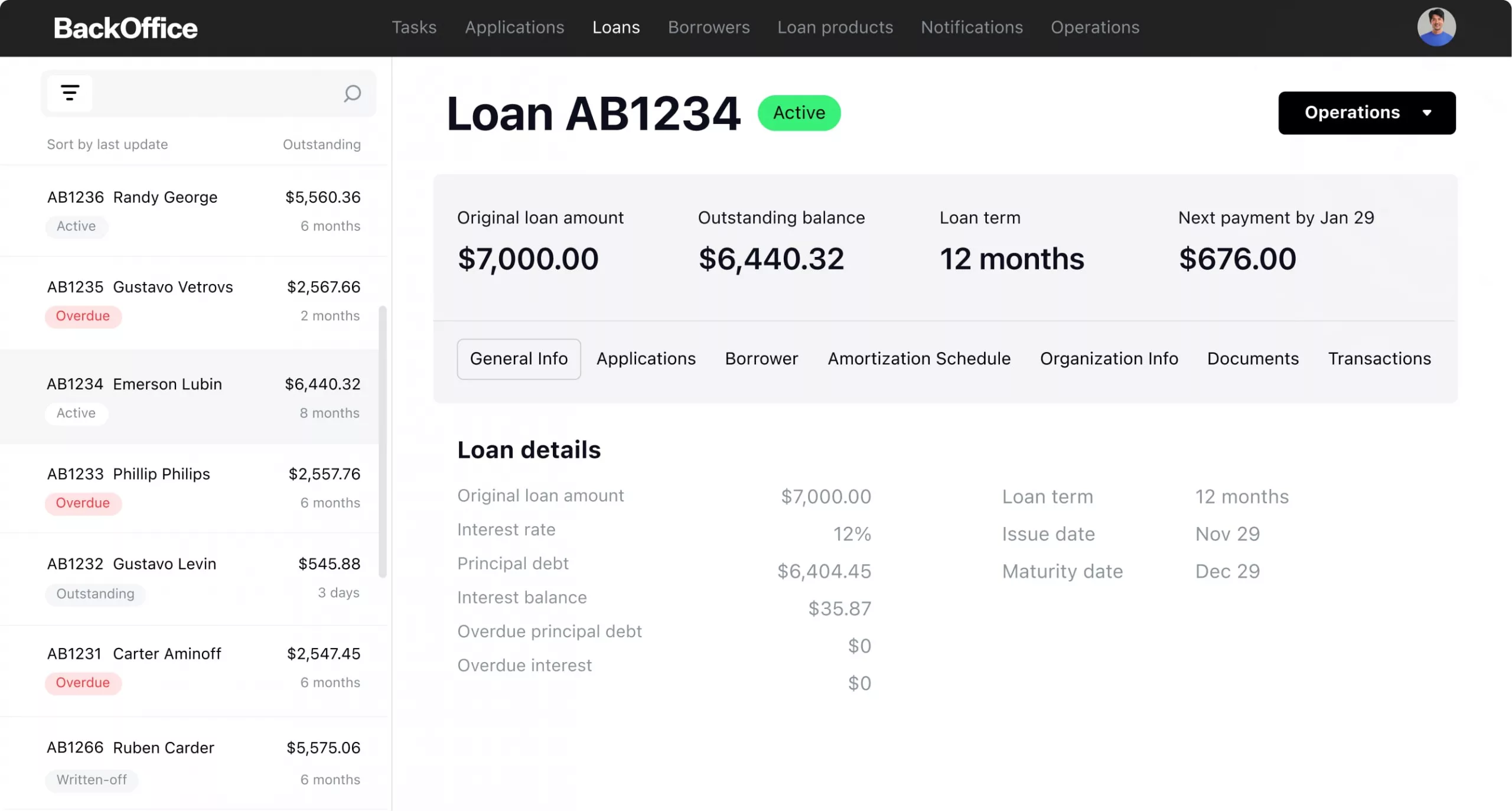

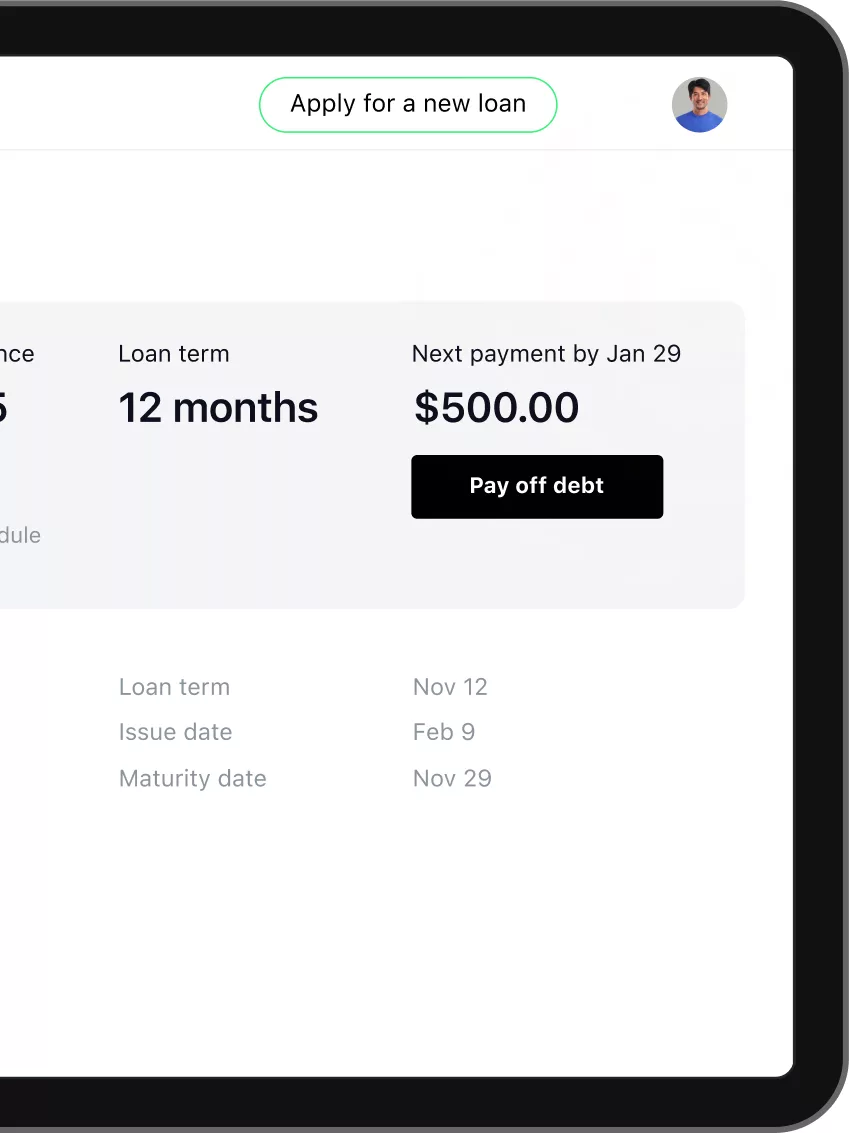

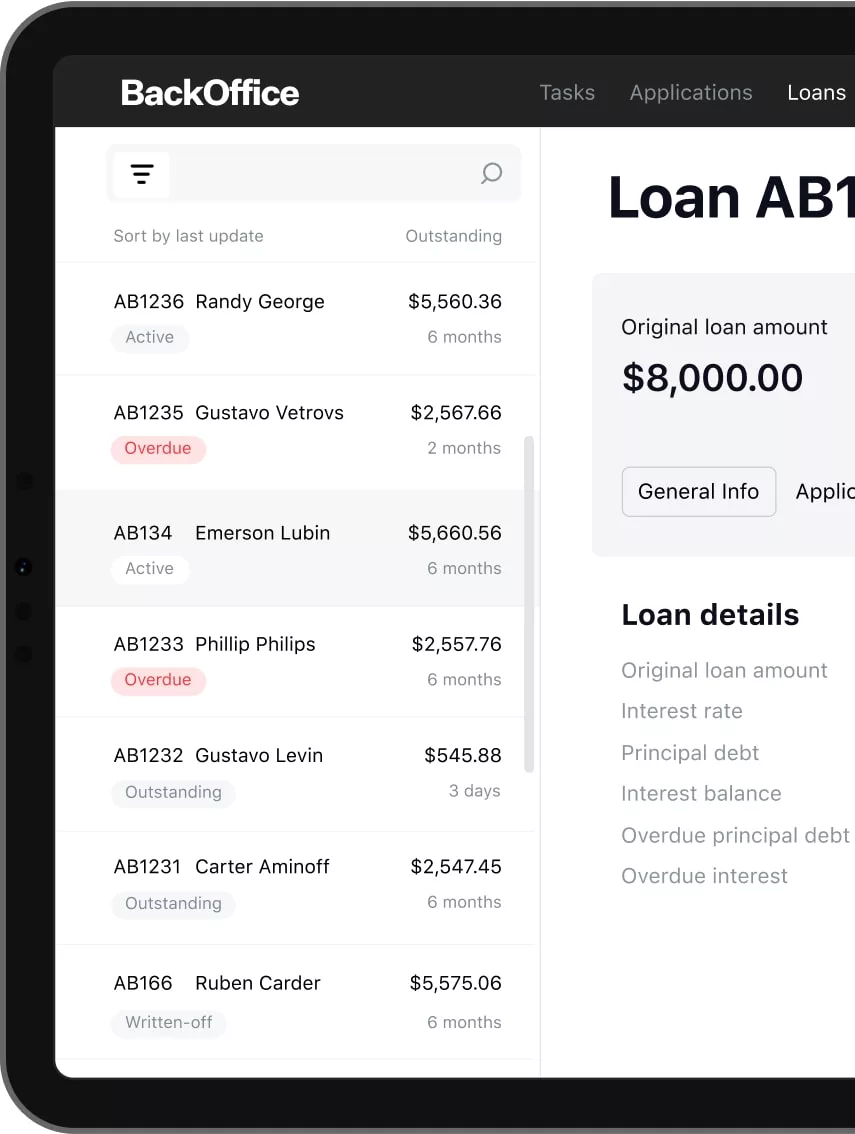

Clean interface makes the loan automation system easy to learn and adopt. Intuitive

features of online lending system

bring an additional boost to your

workflow speed.

features of online lending system

bring an additional boost to your

workflow speed.

2.5x

faster

loan processing

loan processing

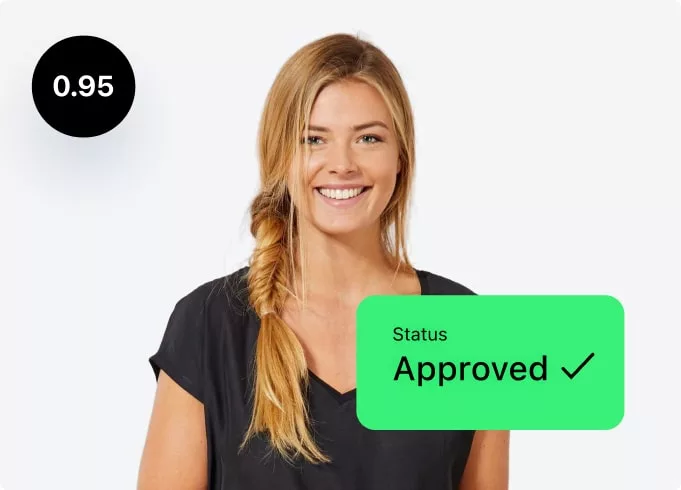

Loan processing automation to accelerate underwriting.

AI

automated loan approval system

scores and

preapproves applications, saving time of your

managers.

AI

automated loan approval system

scores and

preapproves applications, saving time of your

managers.

3.5x

more accurate

loan decisions

loan decisions

Decrease NPLs leveraging the power of AI loan portfolio

assessment. It takes a few

seconds to predict the

probability of repayment and take a

profitable decision.

assessment. It takes a few

seconds to predict the

probability of repayment and take a

profitable decision.

90%

fewer

human mistakes

human mistakes

Replace manual data entry with auto-population of fields

to

eliminate human bias. Leave

no space for human errors

with end-to-end lending process

automation.

to

eliminate human bias. Leave

no space for human errors

with end-to-end lending process

automation.

HES FinTech software solutions make issuing more assets while reducing

NPLs a daily

reality. Using machine learning, our lending platform software analyzes historical data

of closed loans to identify patterns in high-delinquency assets.

NPLs a daily

reality. Using machine learning, our lending platform software analyzes historical data

of closed loans to identify patterns in high-delinquency assets.

Take advantage of AI technology to accelerate loan origination, manage credit risks, and

prognose your financial results.

prognose your financial results.

Autonomously scores applications

Assesses credit portfolios

Predicts defaults

Provides business insights

Monitors predictive model accuracy

Automates debt collection

Multi-field

lending workflow

expertise

Team of BAs with over 10 years of hands-

on experience in

crossfield lending is ready

to meet your specific business needs.

on experience in

crossfield lending is ready

to meet your specific business needs.

Your benefits with HES

Rocket-quick launch

Finance market expertise

Scalability and customization

Customer support

Security and stability

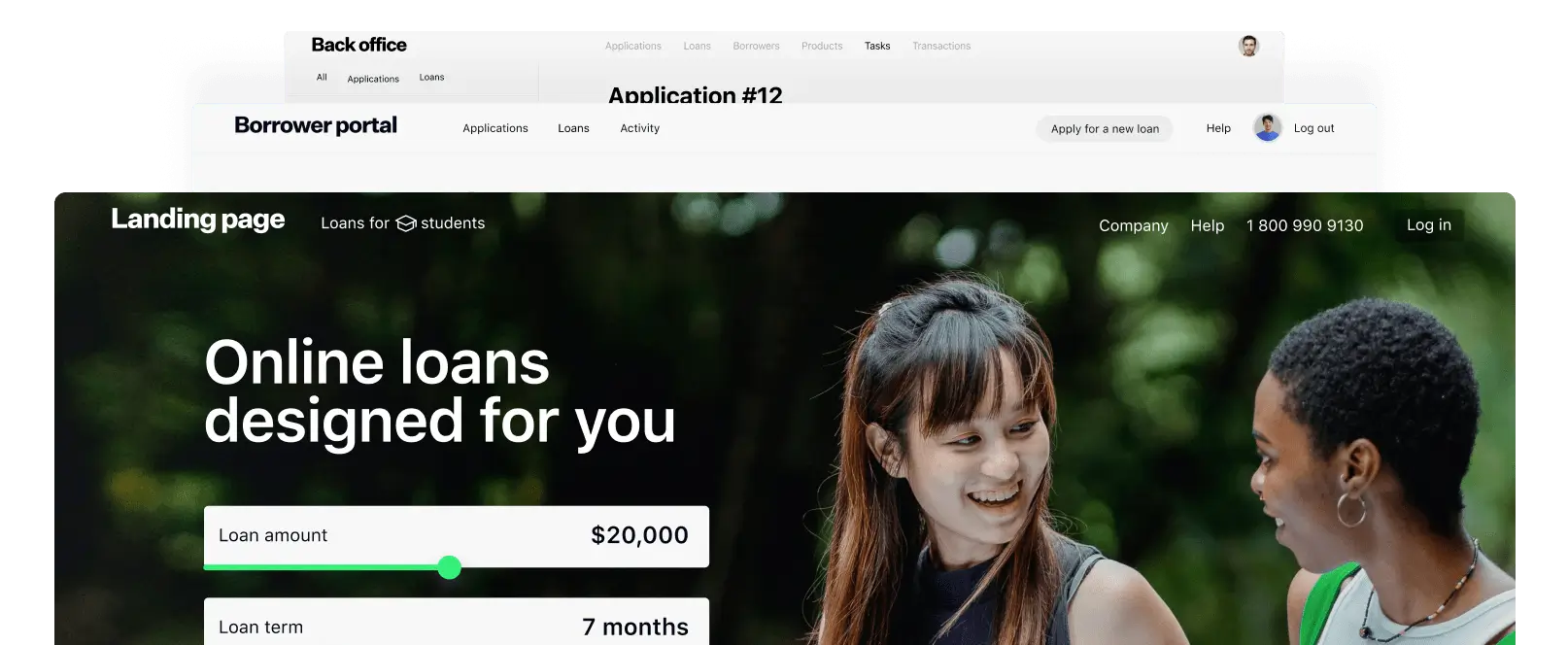

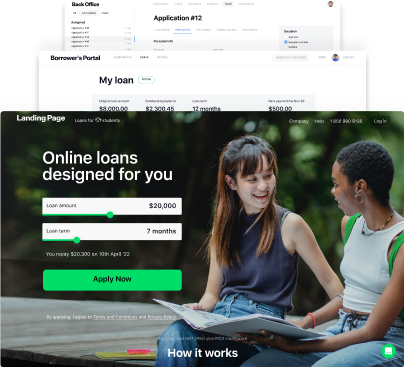

Single loan operating system

to cover all your

needs

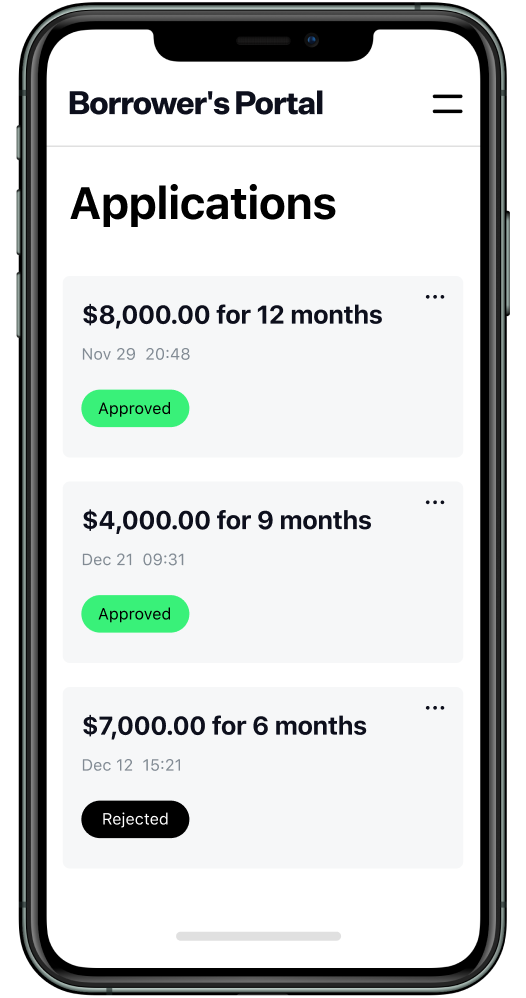

Custom workflows

Visualize your workflow and apply it to the entire system with just one click. The smart lending

platform supports multiple workflows, bringing freedom and flexibility to operate seamlessly.

platform supports multiple workflows, bringing freedom and flexibility to operate seamlessly.

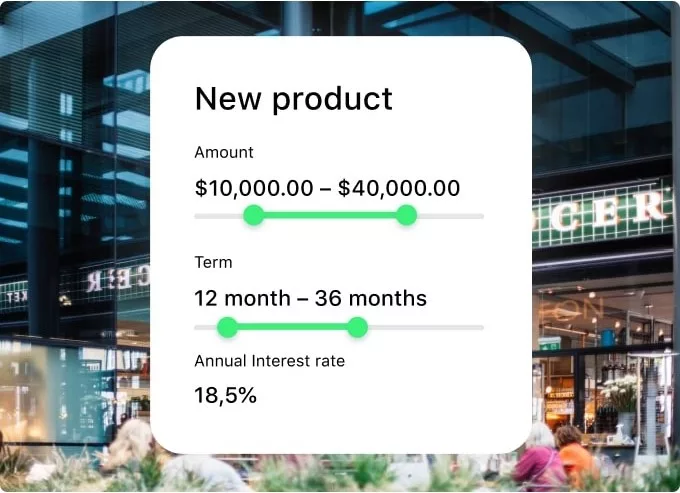

Loan modifications

Launch personalized finance products. Set up credit lines and refinancing, custom calculation

logic, interest rates, fees, and grace periods via loan automation software.

logic, interest rates, fees, and grace periods via loan automation software.

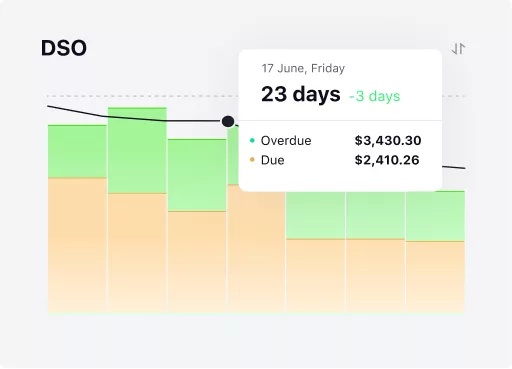

Reports and dashboards

The system gathers values from the database and builds dashboards, measuring your critical KPIs.

Export data and configure the needed metrics. Integrate BI to enhance decisioning.

Export data and configure the needed metrics. Integrate BI to enhance decisioning.

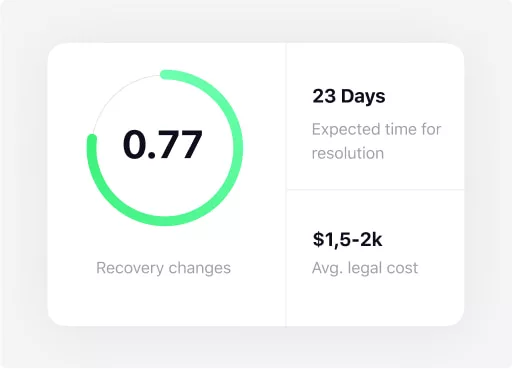

Risk management

Prognose defaults and credit risk. Score credit portfolios with AI to gain actionable insights

into your business. Set the cut-off threshold to define risky assets share and predict NPLs

into your business. Set the cut-off threshold to define risky assets share and predict NPLs

Powerful integrations

Integrate with credit bureaus, payment providers, e-sign, and fintechs specific to your region.

Over 100 APIs are available to bind right away with HES’ automated lending system.

Over 100 APIs are available to bind right away with HES’ automated lending system.

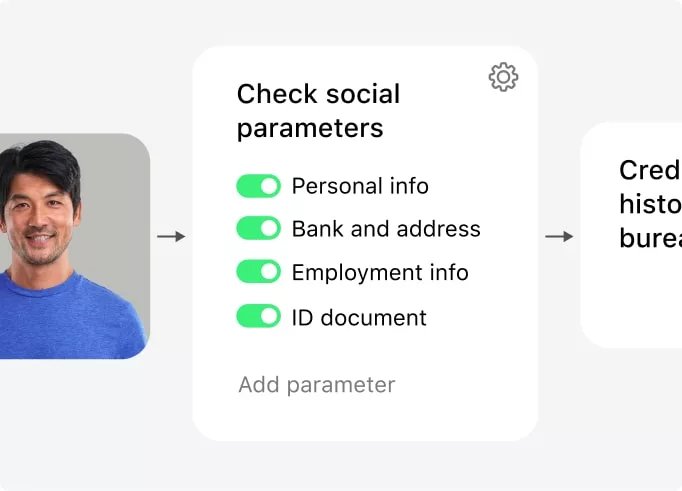

KYC

Automate KYC process and ID verification processes with in-house, AI, or 3rd party integration

while staying compliant with compliance requirements.

while staying compliant with compliance requirements.

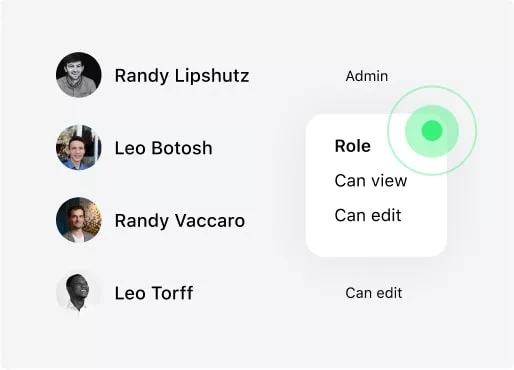

Roles and permissions

Safeguard your business data and minimize risks. Effectively allocate and oversee user roles,

providing access solely to essential modules within your lending system software.

providing access solely to essential modules within your lending system software.

Notifications

Set automatic notifications for your clients. Stay connected with borrowers through SMS and

email, providing updates, auto reminders for due payments, and required actions.

email, providing updates, auto reminders for due payments, and required actions.

Hop on a live demo to learn more

about online loan solution

40

Countries worldwide

160+

Completed projects

300+

Credit products launched

HES FinTech develops lending automation processing systems that provide cost-efficiency and drive

fast operations for financial service companies. Global reach makes HES a reliable technology

partner for compliance and local integrations

fast operations for financial service companies. Global reach makes HES a reliable technology

partner for compliance and local integrations

Trusted

loan

automation

software

Proven lending

automation solution

Custom workflow compliant

2 weeks time-to-market

No limits on assets or customers

No additional charges per user