MoneyMan success story

A consumer lending platform for the fast-growing company in Europe

Learn how MoneyMan launched a microfinance lending business in 7 countries with HES Fintech.

Challenge

360-degree microfinance lending automation

MoneyMan, an innovative online lender, required a fully-fledged flexible solution to automate

the

entire microfinance lending process and operating procedures. The system had to be capable of

running high-performance scoring models in real-time 24/7.

the

entire microfinance lending process and operating procedures. The system had to be capable of

running high-performance scoring models in real-time 24/7.

Approach

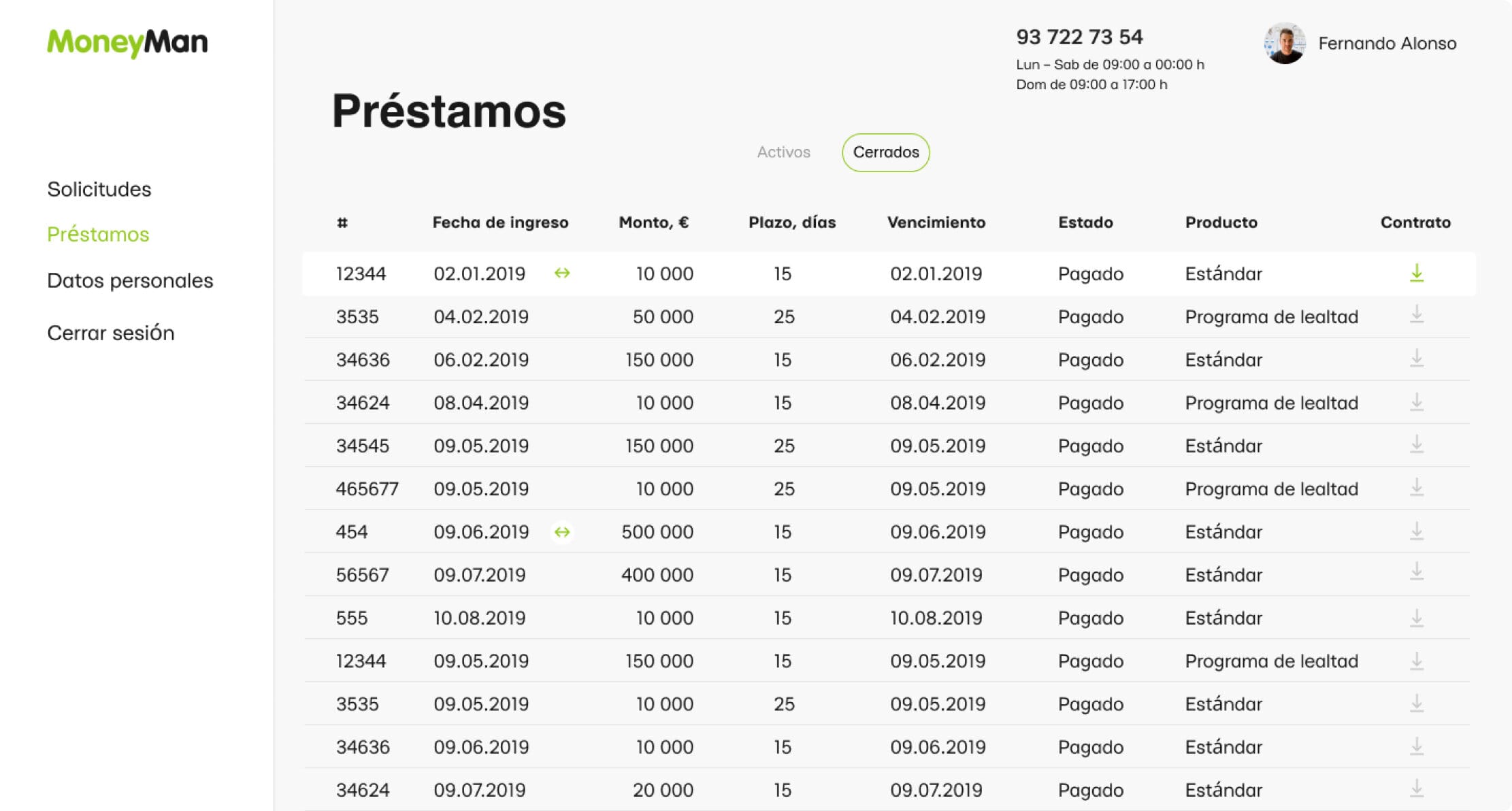

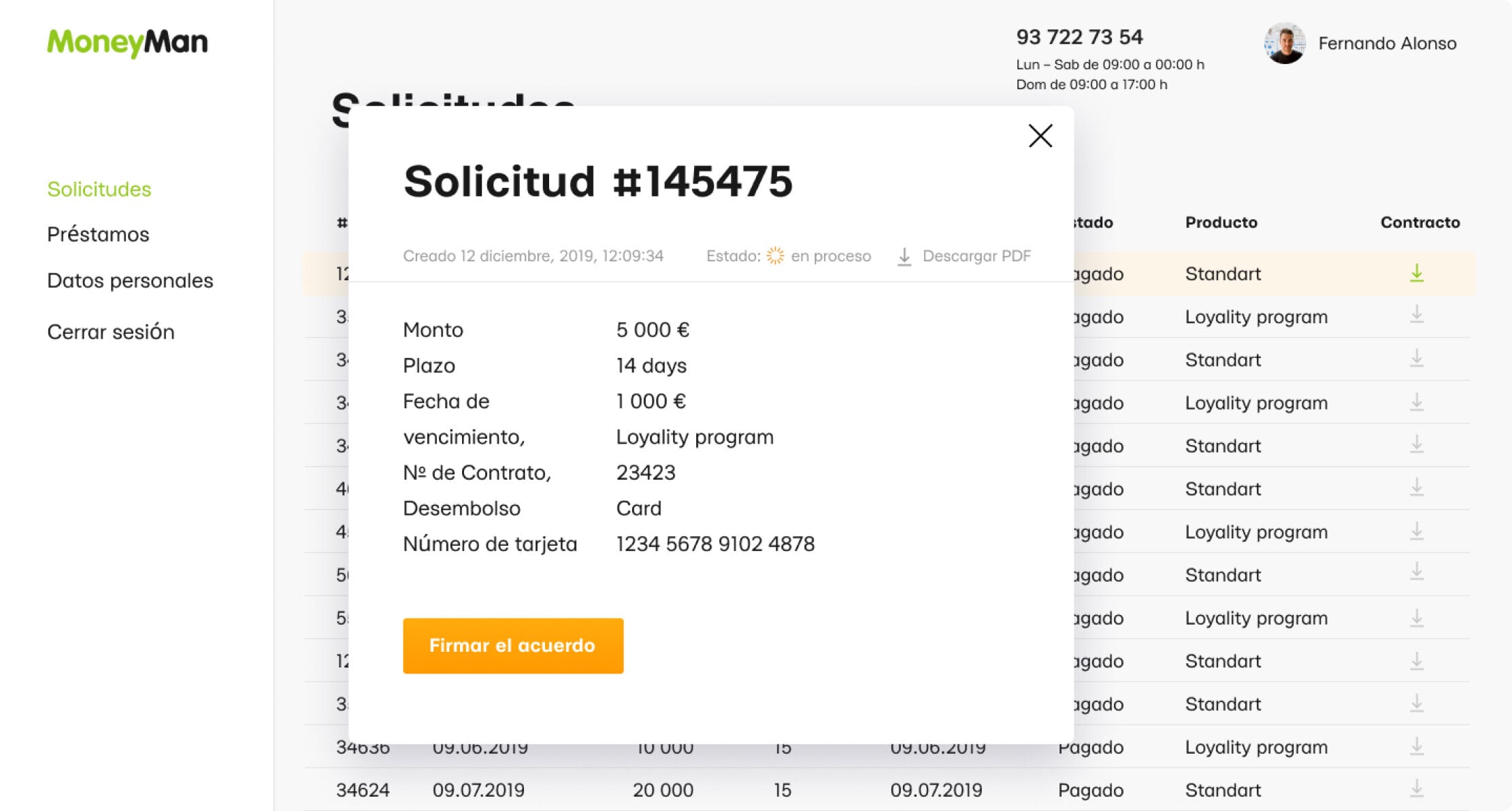

A winning combo of top-notch features and enhanced security

After a thorough business and requirement analysis, HES created an

end-to-end loan management platform with an open upgrade safe architecture and gamification

features.

end-to-end loan management platform with an open upgrade safe architecture and gamification

features.

3 months

Time-to-market

400K

Loans issued via the platform

20-30%

Year-over-year business growth

Result

Technically equipped lending business operating worldwide

Today, the HES microfinance solution enables MoneyMan to scale up and offer loans to an

ever-increasing customer database. The service is now also available in Spain, Georgia,

Kazakhstan, Poland, and Mexico and has issued over 400K loans valued at over $ 80 mn.

ever-increasing customer database. The service is now also available in Spain, Georgia,

Kazakhstan, Poland, and Mexico and has issued over 400K loans valued at over $ 80 mn.

our success to the well-architectured solution created by HES.