Check if your business is truly digital Learn more

Solutions

Consumer lending Microfinance lending POS lending PayDay lending Auto finance Mortgage lending Healthcare lending Student lending Commercial lending Leasing Peer-to-Peer lending Merchant cash advance Bank lending Factoring Working capital finance Trade finance software Loan management software Loan origination software Loan servicing software Debt collection

Products

Clients

Ta Meri Finance

success story

Within two months, HES FinTech implemented the platform with the core logic and

streamlined business processes

streamlined business processes

All

Consumer

Commercial

POS/BNPL

Auto

Other

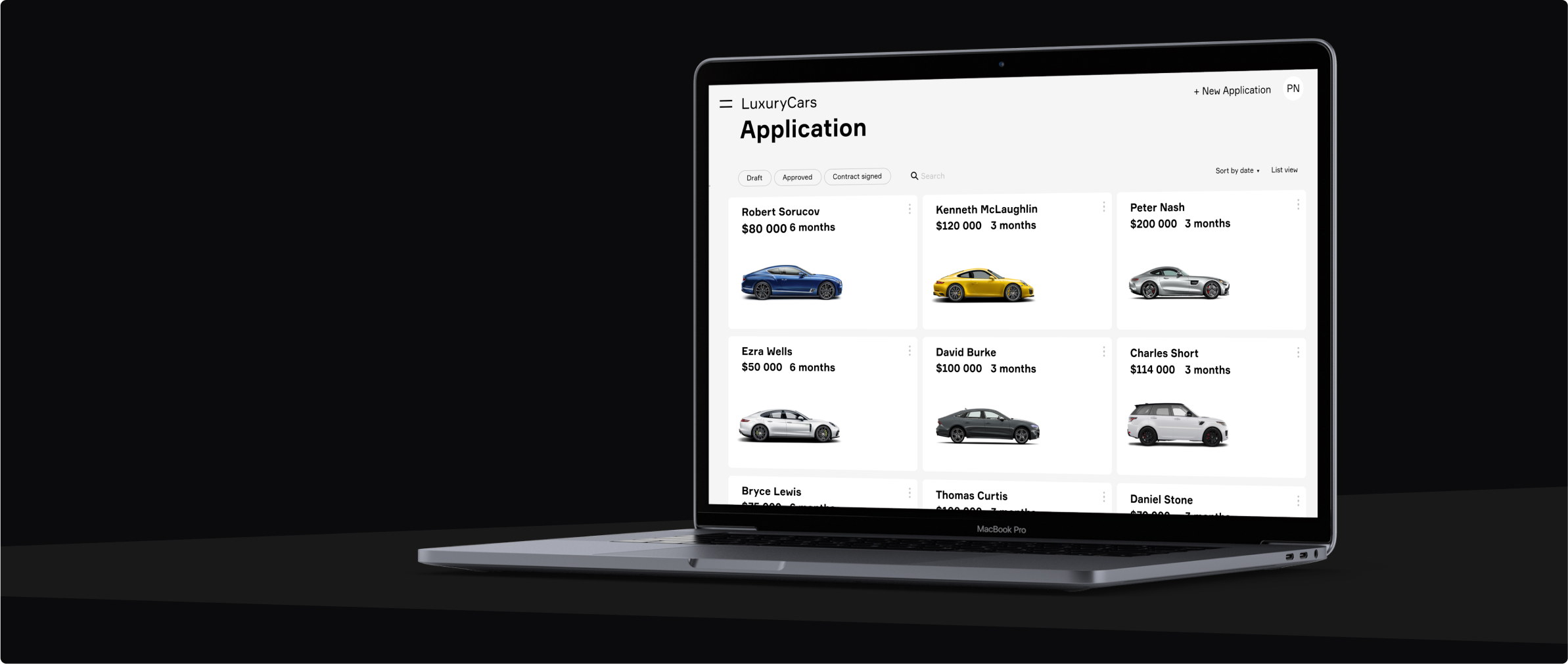

HES FinTech is an experienced technology partner of 130+ financial institutions from North America to

EMEA. To create LoanBox, we combined our domain knowledge in lending software development for financial

service providers and created a comprehensive combo of modules meeting the business processes in full.

EMEA. To create LoanBox, we combined our domain knowledge in lending software development for financial

service providers and created a comprehensive combo of modules meeting the business processes in full.

Issue first loans in a few weeks

Choose your

special offer

Learn more about HES FinTech offers special offer

Free landing website

Boost your loan applications through a lending website,

tailored to your brand identity

tailored to your brand identity

Claim now

Free HES LoanBox usage

Implement now and use our software for free for the

first 3 months of the adoption period

Claim now first 3 months of the adoption period

Bootstrapping hypercare

Get 32 hours of free business analyst support to launch

your digital lending business

Claim now your digital lending business

Free landing

website

website

HES LoanBox

for free

for free

Bootstrapping

hypercare

hypercare